Weekly Investment Insights

“Liberation Day” is Here

Key Takeaways:

- Investors are preparing for “Liberation Day” on April 2nd.

- Trump announced auto tariffs last week, targeting foreign-made vehicles/parts.

- Tariffs are aimed at countries that contribute the most to the $1 trillion trade deficit.

- Industrial metal tariffs have been in place; copper set to be added to the tariffed list.

- Trading partners largely using 2018 retaliatory playbook to respond to tariffs.

“Liberation Day” is Here

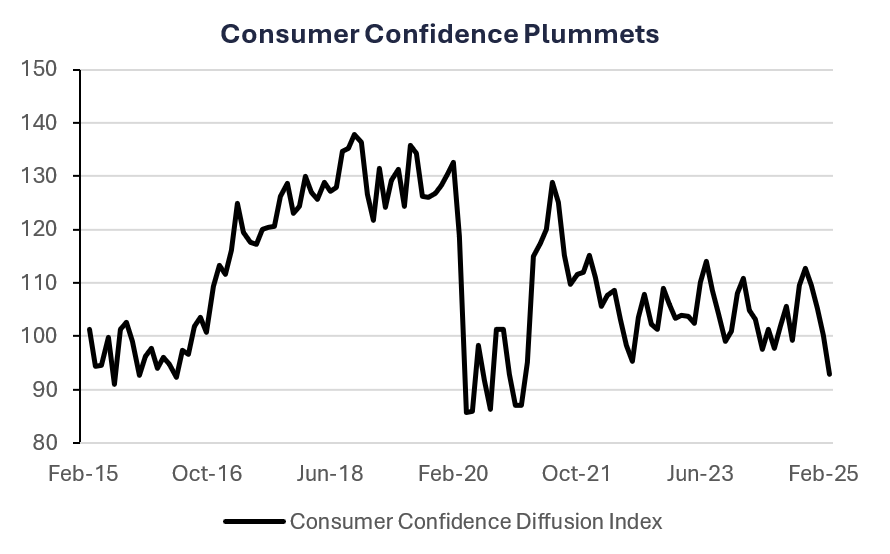

President Trump is referring to April 2nd as “Liberation Day” in the U.S. This is the day that the administration is set to impose reciprocal tariffs to countries that impose tariffs on U.S. goods. At 70 days into the new administration (as of Monday, March 31, 2025), Trump has implemented a 20% tariff on all Chinese goods, a 25% blanket tariff on most imports from Canada and Mexio, and a 25% tariff on US imports of steel and aluminum. As a result, global markets as measured by the MSCI AC World Index have flirted with falling into correction territory (a drop of 10% or more), consumer confidence has deteriorated and inflation expectations have moved higher. In this weekly, we provide an overview of the latest developments from the White House and what it could mean for investors.

- Auto tariffs set to take place: Last week, President Trump announced a 25% tariff on imports of foreign automobiles and specific auto parts. These tariffs are scheduled to begin on April 3rd. The initial tariffs will target fully assembled vehicles only, but by May 3rd, the scope may expand to major vehicle parts, including engines, transmissions, and electrical systems. Various estimates have found the tariffs could raise the average price of a new car by $5,000 – $10,000.1

- What happens on “Liberation Day”: The reciprocal tariffs are expected to target those countries that contribute the most to the ~$1 trillion trade deficit. (e.g., China, Mexico, EU, Vietnam). The goal is to narrow the trade deficit by placing tariffs at an equivalent level that countries charge us when we export to them. For example, the EU charges up to 50% tariffs on U.S. agricultural products. They also have strict non-tariff barriers in place on meat products from the U.S, including quotas and sanitary restrictions. At this point, there is little room to negotiate, as Trump has stated he doesn’t want “too many exceptions”.2

- Industrial metal tariffs: Tariffs on steel and aluminum were implemented on March 12th. In addition, it is believed tariffs on copper will take place within weeks, not months, despite the Commerce Department having until November to submit a report.3

- Responses to tariffs: Global trading partners have responded in a variety of ways. Canada is targeting agricultural and consumer goods at a ~25% rate. The EU is targeting products such as alcohol and motorcycles at a rate up to ~25%. Mexico cited retaliatory tariff plans (not yet in place) of 10%-20% for various agricultural and food products. These tariff responses are largely in line with responses from the previous 2018 trade war.

The Bottom Line:

It has been a difficult quarter for investors as we try to gauge the impact of tariffs when we don’t even know what the ultimate tariffs will be. We should get some clarity this week but the odds of a recession have increased and consumers are worried about higher prices. It is also important to note that corporate profits are at a record high so companies could absorb some of the tariffs. At this point, we believe we will see further downgrades to earnings estimates for 2025 and volatility to remain high.

READ MORE: A Global Downgrade Parade

Your Economic and Market Detailed Recaps

- Consumer confidence falls to lowest since 2021.

- S. economy grows more than expected in 4Q24.

- Core inflation remains sticky.

- Fresh tariff measures rattle global equity markets.

- Treasury yields struggle for direction.

- Precious metals rally as investors flock to safe havens.

Weekly Economic Recap — Consumer Confidence Slides Further

U.S. manufacturing slid back into contraction territory in March, according to the S&P Global flash manufacturing index. The gauge fell 3pts to a reading under 50 led by a drop in the employment component. Sentiment about future conditions among service providers slid to the second-lowest level since 2022.

Home prices increased further in January as buyers continued to grapple with tight inventories. The S&P Case-Shiller index increased 4.7% over the past year, with prices in Los Angeles, Chicago, and Detroit leading the gains. Home prices in Tampa, Dallas and Portland led the cities with price declines.

Consumer confidence fell to the lowest level since 2021 (92.9) in March. The expectations gauge fell to the lowest level in 12 years and inflation expectations over the next year rose to the highest in two years (~6%).

LISTEN IN: Alternate View Podcast

The third reading on 4Q24 GDP showed the U.S. economy expanded at a modestly faster pace than previously estimated in 4Q24 (2.4% vs. 2.3%) driven by an increase in corporate profits. After-tax profits increased by the most in more than two years (5.9%).

The Fed’s preferred inflation gauge, PCE Core, increased more than expected in February (+0.4%). It was the largest monthy gain since January 2024. Goods inflation increased 0.4% for a second straight month, marking the largest back-to-back advance since 2022.

Consumer spending increased modestly in February after posting the worst decline in nearly four years in January. Personal income rose much more than expected (+0.8% vs. 0.4% estimate).

Weekly Economic Recap — Global Equities Falter on Tariff Developments

Equities: The MSCI AC World Index was lower for the fifth time in the last six weeks after President Trump announced fresh tariffs on foreign automobiles and parts. All major averages were lower in the U.S. but it was led by growth and technology. Large cap value outperformed growth for the sixth straight week, as tracked by the Russell 1000 Indices.

Fixed Income: The Bloomberg Aggregate Index was relatively flat as investors stuggled with a weaker economy but also sticky inflation. U.S. TIPS, leverage loans and floating rate instruments outperformed. Municipal bonds were the worst performing sector.

Commodities/FX: The Bloomberg Commodity Index was higher for the fourth straight week. Gold prices finished the week at a record high as investors flock to the safe-haven on fears of a global trade war.Crude oil prices were higher for the third straight week after the U.S. increased tariff pressure on Venezualean oil buyers.

Data is as of March 2025.

Source: FactSet Research Systems, Verdence Capital Advisors