Weekly Investment Insights

When Bonds Matter

Key Takeaways:

- House of Representatives passes Trump’s “One, Big, Beautiful Bill”.

- Bill aims to extend tax cuts, increase spending, and increase U.S. debt ceiling.

- Moody’s downgrade not shocking, citing net interest and deficit as key concerns.

- Bond yields move higher as investors worry “Bond Vigilantes” are coming back.

- Bond market may soon force the government to rethink their fiscal stance.

When Bonds Matter

Moody’s downgrade recently of U.S. sovereign credit and last week’s passing of Trump’s “One, Big, Beautiful Bill” in the House created a complex environment for bond markets. Moody’s cited two primary concerns with their downgrade, including rising interest payment burdens and persistently high fiscal deficits. The combination of a credit downgrade and the passing of an expansive fiscal proposal has heightened scrutiny of the U.S. government’s long-term fiscal credibility. This week’s report aims to offer context on Moody’s downgrade and examines the implications of the proposed fiscal package as it relates to Moody’s two main concerns.

• House passes spending bill… Now what? The House of Representatives narrowly passed the legislation in a 215-214 vote, advancing the fiscal package to the Senate. There, Republicans hold a 53-47 majority and plan to use the budget reconciliation process. Republican leaders are targeting a July 4th deadline to finalize the bill, assuming intraparty divisions do not delay negotiations, before sending the final bill to the President’s desk to sign into law.

READ NOW: Have Trade Wars Deferred Foreigners from Buying U.S. Assets?

• Key components of the fiscal proposal: In its current state, the largest components of the bill extend Trump’s 2017 Tax Cuts and Jobs Act, it increases the cap on SALT deductions to $40,000, imposes work requirements for Medicaid recipients and reduces green energy tax credits. The bill also increases the U.S. debt ceiling by $4 trillion, increases spending on defense and immigration enforcement.

• Moody’s downgrade is not shocking: The Moody’s decision to downgrade the U.S. credit rating is not shocking. As part of their rationale to downgrade the credit rating, Moody’s cited the U.S. deficit and net interest liabilities as key concerns. Net interest outlays have increased 450% over the last 10 years. Additionally, the U.S. fiscal deficit has exceeded 6% of GDP over the past two years. The Committee for a Responsible Federal Budget (CRFB) estimates the proposed bill, in its current state, would add $3 trillion to the debt over the next decade, bringing the total deficit as a percentage of GDP to ~7%.1

• What does it all mean for bonds? Global investors are nervous about the government’s ability to cover budget deficits, questioning if the so-called “Bond Vigilantes” are making a return.2 Last week, the U.S. 30-year Treasury yield peaked at 5.15%. Fear also led to a disappointing 20-year Treasury auction which further contributed to the selloff in long-term bonds.

LISTEN NOW: Markets With Megan

The Bottom Line:

We have witnessed what can happen with interest rates if investors are concerned about the fiscal health of an economy. We can also see that volatility in fixed income can spill into the equity markets, especially those sectors that rely on long-term earnings to justify high multiples (e.g. tech). Since last week, we have seen positive news on trade (U.S./EU) and Japan try to intervene to calm volatility in their long-term rates. We will be watching auctions in the U.S. closely to see if there is further impact on demand that can lead to additional volatility. It is important to remember that long-term rates are tied to net interest costs and many loans, especially mortgages.

Your Economic and Market Detailed Recaps

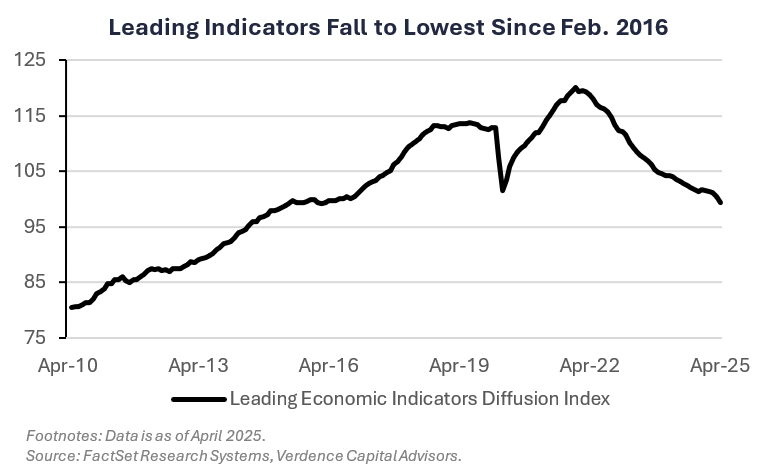

- Leading indicators decline at largest pace since March 2023.

- Housing data showing mixed signs.

- Business activity unexpectedly improves in May.

- Equities falter on Moody’s downgrade and tariff uncertainty.

- Bond yields rise after weak US 20YR bond auction.

- Commodities higher as investors flock to safe-haven gold.

Weekly Economic Recap — Leading Indicators Deteriorate Further

The Leading Economic Indicators Index fell 1% in April, marking the largest monthly decline since March 2023. Virtually all components deteriorated in April, with the exception of manufacturing new orders as businesses aimed to get ahead of tariffs. Consumer expectations led the broad-based decline for the overall index as pessimism has increased each month since January.

Sales of existing homes in April fell to the slowest annualized pace for an April month since 2009 (4 million). There were 1.45 million homes for sale at the end of the month, up 9% from March. This equates to a 4.4 month supply, the highest in five years. The median selling price hit a record high ($414k) but the pace of gains was the slowest since July 2023.

Sales of new homes unexpectedly rose in April to the highest level since February 2022. Sales in the South and Midwest contribted the most to the headline increase. The median sales price decreased 2% from a year ago to $407,200.

U.S. business activity unexpectedly improved in May according to the S&P Global flash PMI Index. The Index increased to a three-month high (52.3) driven by the fastest growth in new orders in more than a year. A measure of stockpiles of materials and other inputs surged to the highest level in data history, going back to 2007.

Weekly Market Recap — Global Equities Fall Amid Moody’s Downgrade and Higher Bond Yields

Equities:

The MSCI AC World Index was lower for the second time in the last three weeks. Major U.S. averages were all lower for the week with small and mid cap equities faring the worst. The small-cap Russell 2000 fell for the first time in seven weeks. The S&P 500 and Dow Jones Industrial Average both fell back into negative territory for the year.

Fixed Income:

The Bloomberg Aggregate Index was lower for the fourth straight week as bond yields moved higher. A weaker-than-expected auction of U.S. 20 year Treasury bonds, paired with the Moody’s downgrade, pushed longer-dated yields sharply higher. Floating rate bonds were the only sector of fixed income higher for the week.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second time in three weeks. Investors flocked to safe-haven assets during the week amid Moody’s downgrade and Trump’s renewed tariff threats. Gold prices were higher by the most in six weeks as a result. Tariff uncertainty and a weaker U.S. Dollar drove investors to industrial metals, sending copper prices higher by the most since February.

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors