Weekly Investment Insights

Economic Update May 2025

Key Takeaways:

- Inflation showing some signs of easing.

- Consumers slow their pace of spending.

- Global equities rally as investors flock to beaten down growth trade.

- Bond yields move higher on Moody’s downgrade and heightened uncertainty.

- Commodities fall for second straight month.

- Economic Update May 2025

April Showers Brought (Some) May Flowers

The storms of April came and went as May offered equity investors a reprieve from the painful volatility seen the prior month. Global equity markets were higher as tariff-related negotiations accelerated. However, bond markets experienced increased volatility after Moody’s downgrade to the U.S. credit rating and the House passed a fiscal spending package that threatens to worsen the budget deficit. This week we offer a review of the month of May from an economic and asset class perspective.

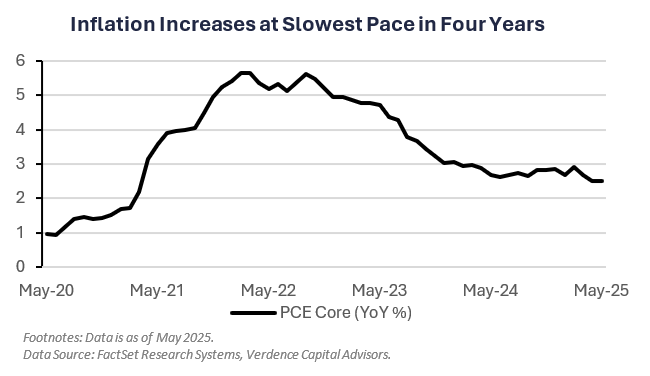

• Inflation showing signs of cooling: The Fed’s preferred inflation gauge, PCE Core, increased at its slowest annualized pace in nearly four years (2.5%) last month and the headline Consumer Price Index increased at its slowest pace since 2021 (2.3%).

• Fed to remain cautious: The Federal Reserve kept interest rates unchanged in May (4.25% – 4.50%) amid elevated risks to inflation and stated that a “cautious approach” to policy is necessary. The uncertainty around tariffs has the Fed in a “wait and see” mode.

• Sentiment weakening: Optimism among small business owners fell to its lowest level since October as tracked by the NFIB. Consumer expectations about the future health of the economy as measured by the University of Michigan Index fell to the lowest level since 1980.

• Consumers slow pace of spending: Inflation-adjusted personal spending increased only 0.1% last month, slower than the 0.7% increase the prior month.

Global Equities:

The MSCI AC World Index was higher by the most since November 2023.

• U.S. leads global performance: U.S. equities outperformed the other developed markets as the S&P 500 was higher than the MSCI EAFE Index for the first time since November 2024.

• Growth back in the spotlight: All “Magnificent 7” components were higher in May, and the Russell 1000 Growth Index outperformed its Value counterpart by the most since December 2024.

Fixed Income – Bond yields rise:

The Bloomberg Aggregate Index was lower for the first time this year as government spending plans and a rating downgrade sent long-term yields higher.

• Moody’s downgrade U.S. debt: A U.S. credit rating downgrade sent long term bond yields sharply higher in May. The 10YR and 30YR bond yield rose ~25bps for the month.

• Riskier fixed income sectors outperform: High yield corporate bond prices were higher for the second straight month and by the most since September 2024 as risk appetite was strong.

Commodities – Grains lower on weather forecasts:

The Bloomberg Commodity Index was lower for the second straight month as weakness in soft commodities (e.g. coffee) and grains overshadowed the rally in oil.

• Grains underperform: Grains, such as corn and wheat, were lower in May amid trade dynamics and better supply than expected.

READ MORE: When Bonds Matter

Your Economic and Market Detailed Recaps

- Consumer confidence surges amid trade optimism.

- Fed remains uncertain about economic outlook.

- Fed’s preferred inflation gauge continues to moderate.

- Global equities higher despite trade uncertainty.

- Yields fall as investors digest economic data.

- Crude oil falls on production increase from OPEC+.

Weekly Economic Recap — Inflation Eases Further but Fed to Remain Cautious

Home prices were higher in March according to the S&P Case-Shiller Index, but eased from the prior month. Prices in Cleveland, Seattle, and New York led the gains for the month. The only cities monitored that experienced price declines for the month were Miami and Tampa.

Pending home sales fell at the fastest monthly pace since September 2022 (-6.3%). The share of homes sold that were canceled in the three months through April increased to 7%, the highest since January 2024.

U.S. consumer confidence increased at its fastest monthly pace (+12.3 pts) in four years as optimism broadly improved. The six-month expectations gauge increased by the most since 2011. A larger share of consumers plan to buy large-ticket items, including cars, homes, and major appliances as well.

WATCH NOW: Alternate View Podcast

The Federal Reserve released their May meeting minutes which stated, “participants agreed that uncertainty about the economic outlook had increased further… appropriate to take a cautious approach.” Members marked down their expectations for economic growth in 2025 and 2026 and “almost all” participants noted the risk inflation could prove more persistent than expected.

The U.S. economy contracted less than orignally expected in 1Q25 (-0.2% vs. -0.3%) supported by stronger business investment and a greater accumulation of inventories. Consumer spending increased 1.2% (down from 1.8%), its slowest pace in nearly two years. Net exports subtracted nearly 5 percentage points from the GDP number, the largest on record.

The Fed’s preferred inflation gauge, PCE Core, increased at the slowest annualized pace in four years (2.5%).

Weekly Market Recap — Global Equities Climb; Yields Fall Amid Busy Week of Data

Equities:

The MSCI AC World Index was higher for the second time in the last three weeks. Markets faced volitility, however, as trade uncertainty remained heightened. Major averages in the U.S. were higher for the week but finished off their best levels. Rate sensitive areas led performance, specifically growth/tech; the Nasdaq was the best performing index. European markets were higher after President Trump announced he would give the EU more time to negotiate before 50% tariffs took effect.

Fixed Income:

The Bloomberg Aggregate Index was higher for the first time in five weeks. Investors parsed through the latest Fed minutes and digested a better-than-expected seven-year note auction. Bond yields finished the week generally lower and all sectors of fixed income were higher as a result.

Commodities/FX:

The Bloomberg Commodity Index was lower for the second time in three weeks. Crude oil prices were lower for the second straight week as OPEC+ producers announced plans to increase production. Gold prices were relatively flat as consumer confidence improved and inflation showed signs of easing.

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors