Weekly Investment Insights

Deep Dive into Labor Market Indicators for Clues to Fed Actions

Key Takeaways:

- Labor Market Indicators

- Demand for workers weakening.

- Job openings stable; layoffs increasing.

- Low quits rate suggests employees less confident to find new job.

- Small business owners hiring plans slowing.

- Fed rate cuts to be a 2H25 story despite early signs of softening labor market.

Deep Dive into Labor Market Indicators for Clues to Fed Actions

We realize that many investors are questioning when the Federal Reserve will be able to resume their interest rate cuts. It is important to understand that the Fed has a dual mandate, price stability and maximum employment. While we are approaching price stability with headline inflation (CPI YoY) decelerating from a 9.1% annual growth rate to 2.3%, it still remains slightly above the Fed’s target. In addition, there are upside risks with the ongoing tariff uncertainty. This has justified the Fed maintaining a wait and see approach. As we look to the labor market, it has been surprisingly resilient.

However, last week we received a variety of data on the labor market that could suggest the Fed may be able to resume interest rate cuts in 2H25. In this weekly insights, we offer a better look into the labor market given the indicators we received last week.

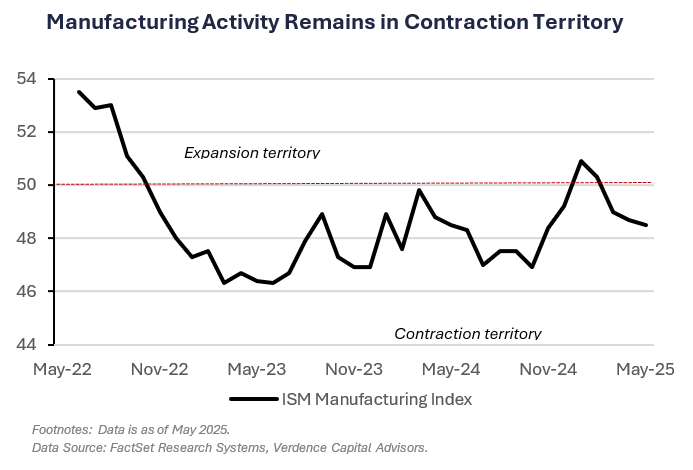

- ISM surveys show weak demand for workers: In both the ISM Manufacturing and Services Index, the employment component indicated the unemployment rate may increase from current levels. The ISM Manufacturing employment component remained in contraction territory (a reading below 50) for the 26th month out of the past 29 months. While services employment edged slightly into expansion territory in May, respondents to both surveys indicated tariff-related uncertainty and cost management efforts as key reasons for a broad easing in demand for workers.

- Job openings stable, but underlying data softening: The April JOLTS report indicated job openings remained relatively stable despite economic and tariff-related uncertainty. However, the difference between job postings and those unemployed has narrowed substantially (from 6.2 million more job postings than those unemployed to 225K more job postings). This suggests the labor market is normalizing and the economy is weakening so employers are reducing job postings. In addition, layoffs increased to the highest level in six months. The quits rate (i.e., those who have voluntarily left their jobs) ticked lower for the first time in five months in April suggesting workers are less confident in quitting their job and easily finding a new one.

- Small businesses impacted: According to the most recent data from the NFIB, small business hiring plans remain historically low. Small businesses accounted for ~60% of total net job creation from 2013 – 2023.1 The most recent hiring plans registered a reading of 13, which is less than the trailing 12-month average (15). Since 1973, when this reading is between 10-15, our analysis shows the average unemployment rate (currently at 4.2%) is ~5.5%, suggesting there may be more deterioration in the labor market to come.

The Bottom Line

We think with the recent labor market data, the slowing in the economy and progress on inflation the Fed will be able to resume rate cuts at their September meeting. However, we expect any rate cuts to be delivered with a “hawkish” rhetoric. With inflation improving but not at the Fed’s target and upside risks to inflation due to tariff related uncertainty, the Fed must walk a fine line. They need to articulate that they prefer a wait and see approach as opposed to a stop and go approach.

READ MORE: Economic Impact of Tariffs

Your Economic and Market Detailed Recaps

- Manufacturing activity contracts for third straight month.

- Job openings unexpectedly increase.

- S. economy adds more jobs than expected.

- Global equities rally on U.S./China trade optimism.

- Yields move higher as risk appetite increases.

- Commodities rally on crude oil strength.

Weekly Economic Recap — Labor Market Remains Resilient, but Weakness Emerging

Manufacturing activity in the U.S. contracted for a third straight month in May as the ISM Manufacturing Endex registered a reading below 50 (48.5). A gauge of imports fell to a 16-year low as firms pulled back amid tariffs. Exports fell to the lowest level in five years.

Economic activity in the services sector unexpectedly contracted in May for the first time since June 2024. Business activity registered the weakest reading in nearly five years. New orders contracted and prices paid increased driven by tariffs.

Job openings unexpectedly increased in April to 7.39 million, from a revised 7.2 million in March. The advance was driven by private-sector industries, including professional/business services and health care. Hiring advanced to the highest level in nearly a year, while the number of layoffs climbed to the highest since October. The quits rate dipped to 2% (from 2.1%) as workers seem less confident in their ability to find a new job.

WATCH NOW: Alternate View Podcast

The U.S. trade deficit narrowed in April by the most on record. The gap in goods and services trade plummeted 55.5% from the prior month, the smallest since 2023. Imports of goods and serviced declined a record 16.3% in April while exports increased 3%.

The U.S. added 139K new jobs in May which was slightly more than anticipated but the prior two months were revised lower by 95K jobs. The unemployment rate remained unchanged as both the labor force declined and household employment fell.

Weekly Market Recap — Global Equities Move Higher as Investors Parse Through Data

Equities:

The MSCI AC World Index was higher for the second consecutive week. Investors saw the weak economic data in the U.S. as sign the Fed can start cutting interest rates again. All the major global averages rallied with the exception of Japan. The U.S. led the rally, specifically in the small and midcap space. The Russell 2000 Index rose the most and was higher for the eighth time in the last nine weeks. Shares in China were also higher last week after a late-week phone call between President Trump and Xi gave investors hope for continued tariff talks.

Fixed Income:

The Bloomberg Aggregate Index was lower for the fifth time in the last six weeks as U.S. Treasury yields rose. The only areas of fixed income that were positive last week were high yield and emerging market.

Commodities/FX:

The Bloomberg Commodity Index was higher by the most since January. Crude oil prices were higher by the most since November as investors digested positive developments from talks between President Trump and Xi. Soft commodities were also sharply higher driven by coffee prices, on weather and tariff-related concerns.

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors