Weekly Investment Insights

2Q25 Earnings Season Outlook

Key Takeaways:

- Major financial firms kick off 2Q25 earnings season tomorrow.

- Communication services to lead S&P 500 EPS growth.

- Technology still strong; semiconductor industry the largest contributor.

- Large annual drop in oil prices hurting earnings growth for the energy sector.

- Profit margins strong in 1Q25, but are companies passing increased costs on to consumers?

2Q25 Earnings Season Outlook

Expectations for 2Q25 Earnings Season Outlook. The unofficial start to earnings season begins tomorrow with major financial companies slated to release 2Q25 results (e.g., JPMorgan, Wells Fargo). We hope to gain insight into how companies are dealing with economic and political uncertainty. Analysts expect S&P 500 earnings to grow ~5.0% year over year, marking the eighth consecutive quarter of earnings growth.1 It would also mark the slowest growth since 4Q23. This week, we outline what investors can expect from 2Q25 earnings season.

- Financials take center-stage: Nearly 50% of all S&P 500 companies reporting earnings this week come from the financials sector. Analysts expect the sector to report the fifth-highest annual growth rate of all 11 sectors (2.4%). And analyst expect the major banks industry group to be the largest detractor from growth (-11% YoY) led by JPMorgan Chase. The company’s challenging year-over-year comparison relates to a $7.9 billion gain in 2Q24 from Visa shares, according to FactSet. Excluding JPMorgan, the industry group would report 9.3% earnings growth.

- Communications to lead growth: We expect the communication services sector to report the highest year-over-year growth rate of all eleven sectors (+29.6%). Warner Bros. Discovery is expected to lead the sector, benefiting from an easy comparison to last year when the company reported a $9 billion goodwill impairment charge. If the company were excluded from the sector, the growth rate would be 8.2%.

- Technology strong: The tech sector is expected to report the second-highest growth of all 11 sectors (+16.6%), driven by the semiconductor industry. They are expected to be the largest boost to growth for the tech sector. If the industry were excluded, the growth rate would be 8.6%.

- Energy weakest: The energy sector is expected to report a year-over-year earnings decline of -25.8%. The sector was challenged by lower oil prices (average of $80.9 usd/bbl in 2Q24 vs. $63.9 in 2Q25). Oil prices were lower driven by geopolitical tensions impacting the global supply/demand outlook.

The Bottom Line:

According to FactSet, over the last ten years, the final earnings reported by companies exceeded expectations by ~7.0%. If we apply this figure to the current estimate, S&P 500 earnings could grow above ~10% which would be the fourth out of the past five quarters seeing double-digit earnings growth. We welcome strong earnings but we are more interested in what companies are saying about the future path of earnings.

We will be watching how companies are handling the current tariffs and budgeting for the future given the uncertainty. Also, we will monitor which sectors are passing on higher costs and which sectors are taking a hit on margins. And we will assess what is being reported about the “One Big Beautiful” tax bill, especially how recent regulatory changes may aid future earnings (e.g. Financials). In addition, are companies increasing capex spending due to favorable expensing measures? Lastly, what are companies saying about the labor market? The labor market has been strong, but cracks are emerging and may affect the economic outlook.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Consumer borrowing slows driven by revolving credit.

- Fed officials’ uncertainty still elevated driven by tariff impact.

- U.S. government posts budget surplus amid tariff receipts.

- Global equities lower on increased tariff rhetoric.

- U.S. Treasury yields higher; investors reprice inflation.

- Commodities driven higher by oil and copper prices.

Weekly Economic Recap — Fed Rate Expectations Diverge Amid Uncertain Tariff Impact

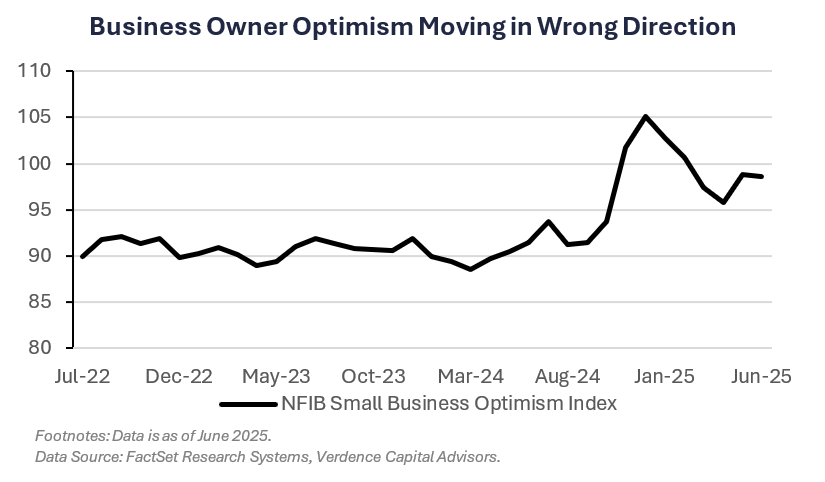

Sentiment among small business owners fell slightly in June as owners continued to contend with Trump’s tax bill (the survey was completed before the House vote). Nearly 20% of firms (by the NFIB) ranked taxes as the most important problem, the highest in ~four years. Inventories were the largest detractor from optimism, as some reported stockpiles as being too high.

U.S. consumer borrowing increased at the slowest pace in three months in May driven by a pullback in revolving debt. Revolving credit (which includes credit card balances) declined $3.5 billion, the first decrease since November. The average rate on credit card accounts with assessed interest was 22.25% in May, close to the highest since 1995.

The minutes from the June FOMC meeting showed diverging expectations on the appropriate monetary policy path, driven by how tariffs might affect inflation. “Most participants noted the risk that tariffs could have more persistent effects on inflation, while a few participants noted tariffs would lead to a one-time increase in prices.” However, most policymakers assessed that “some reduction” in interest rates would be appropriate this year.

The U.S. government posted a surprise budget surplus in June as tariff receipts surged. Customs duties totaled $27 billion in June, ~300% higher compared to a year ago. Net interest payments on the national debt totaled $84 billion in June, climbing to $749 billion for the fiscal year thus far.

Weekly Market Recap — Global Equities Fall Amid Increased Tariff Rhetoric; Growth Outperforms

Equities:

The MSCI AC World Index was lower for the first time in three weeks as President Trump reignited tariff fears. All major U.S. averages were lower to finish the week but tech (i.e., Nasdaq) outperformed on a relative basis. The Dow Jones Industrial Average was lower for the first time in four weeks and was the weakest performing average as investors rotated into growth sectors. European markets finished broadly higher on optimism of trade negotiations still on the table.

Fixed Income:

The Bloomberg Aggregate Index was lower for the second consecutive week as Treasury yields inched higher on concern that higher tariffs could fuel inflation. Floating rate instruments, Municipals and U.S. TIPS were among the best performing sectors while long term Treasuries and investment grade credit led the weakness.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second straight week. Crude oil prices finished the week higher as investors weigh tariff implications on global supply/demand. Copper prices were higher after Trump threatened a 50% tariff on the metal.

WATCH NOW: Alternate View Podcast

Data is as of June 2025.

Source: FactSet Research Systems, Verdence Capital Advisors