Weekly Investment Insights

Summer Equity Rally Heats Up – July Market Recap

Key Takeaways:

- U.S. equities hit record high.

- Fed keeps interest rates unchanged, but dissenters emerge.

- Large-cap growth leads to U.S. market dominance globally.

- Bond yields whipsawed on rate cut outlook.

- U.S. Dollar strengthens for the first time this year.

Summer Equity Rally Heats Up – July Market Recap

It was all sunshine in July for U.S. equity investors. The S&P 500 made its 15th record high for the year during the month as the White House announced multiple trade deals, economic data proved resilient and 2Q25 U.S. earnings season started better than expected. The U.S. economy rebounded from the first negative quarter since 2022 (in 1Q25) and posted a solid 3.0% annualized growth rate for 2Q25. However, the downward trajectory to inflation stalled and the Fed kept interest rate policy unchanged at their July FOMC meeting. There were two diseenters who wanted the Fed to cut rates, which was the most since 1993. In this weekly insights, we offer investors a deeper dive into the month of July from an economic and asset class perspective.

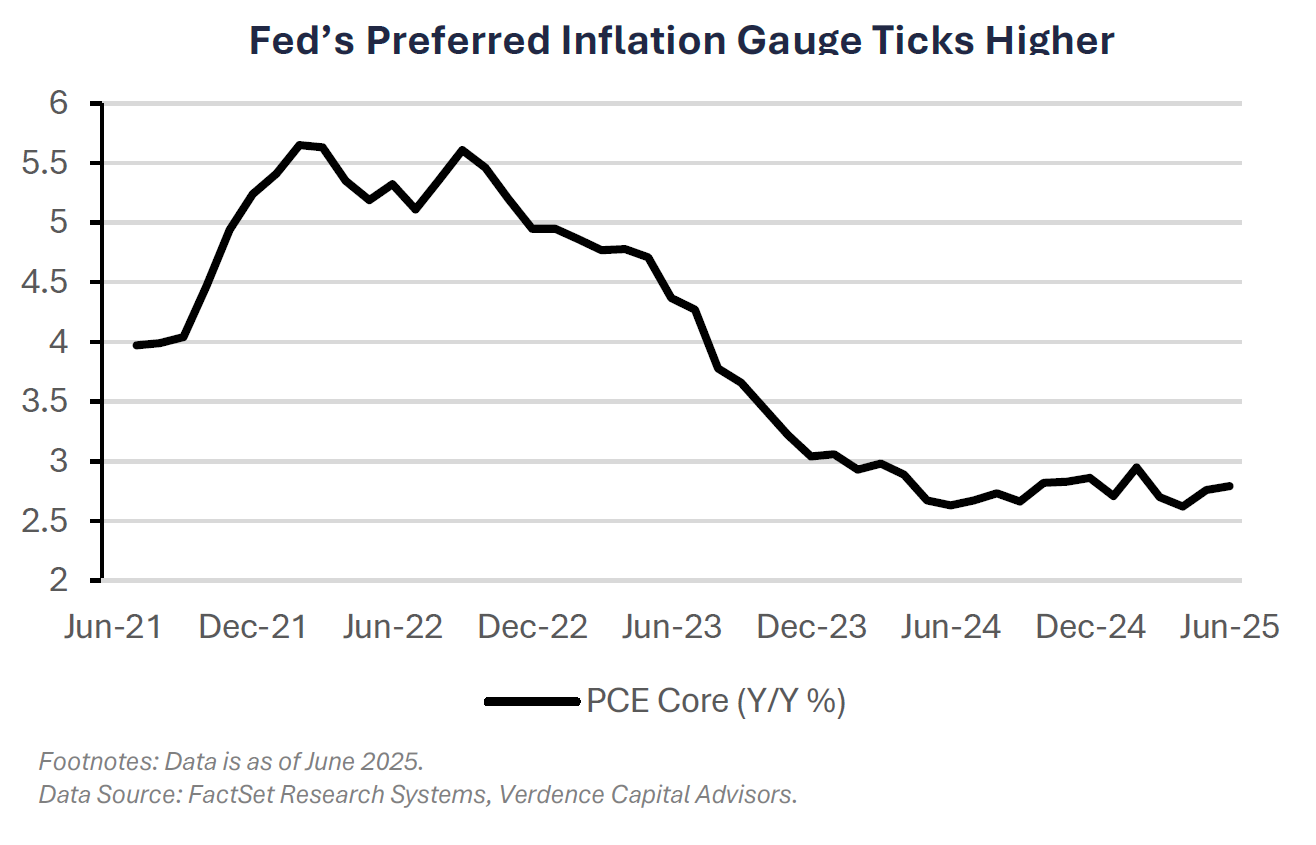

- Inflation moving in the wrong direction: The Fed’s preferred inflation gauge, PCE Core, increased more than expected (2.7% YoY) and moved away from the Fed’s 2.0% inflation target. According to the Consumer Price Index (ex energy) prices were led higher by the costs of healthcare, shelter and apparel.

- Mixed signs from housing: Home sales struggled amid elevated rates and limited supply. However, we are staring to see inventories of new and exisitng homes increase.

- Consumer sentiment improved: Consumer sentiment rose to its highest level in five months (University of Michigan Index) as trade fears faded.

- Labor market weaker: The U.S. added 73K jobs in July but the prior two months were revised lower. This brought the three month moving sum of job creation to the slowest pace since June 2020.

Global Equities – U.S. leads: The MSCI AC World Index was higher for the fourth straight month. However, when excluding the U.S., the Index fell for the second month this year.

- S. markets outperform led by mega-cap tech: The Russell 1000 Growth Index outperformed the Russell 1000 Value Index by ~320bps. The “Magnificent 7” constituents were all higher (except Tesla) with Nvidia leading performance.

- Emerging markets rallly, developed lags: The MSCI EM Index outperformed the MSCI EAFE Index for the second straight month. Equities in China led performance on positive trade negotiations with the U.S.

Fixed Income – Bond yields higher: The Bloomberg Aggregate Index fell by the most this year after bond yields rose as investors repriced Fed rate cut expectations.

- Municipal and Treasuries lag: Municipal and Treasury bonds fell the most as interest rates rose. In contrast, risky fixed income (e.g., high yield and EM bonds) rallied.

Commodities – U.S. Dollar strength: The Bloomberg Commodity Index was lower for the third time in the last four months driven by weakness in industrial metals.

- Metals and tariffs: Copper prices fell the most since June 2022 on lack of clarity around tariffs.

U.S. Dollar higher for first time this year: The U.S. Dollar appreciated for the first time this year in July driven by positive trade negotiations.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Fed keeps rates unchanged as uncertainty remains elevated.

- Fed’s preferred inflation gauge climbs more than expected.

- Labor market cracks getting bigger.

- Global equities lower as trade policy uncertainty reignites.

- Bond yields plummet as investors weigh tariff policy.

- Commodities drop driven by copper prices.

Weekly Economic Recap — Fed Keeps Rates Unchanged but Dissenters Emerge

Consumer confidence as measured by the Conference Board increased in July as optimism around the outlook for the economy and labor market offset weak sentiment on the current condition of the economy.

U.S. economic activity increased more than expected in 2Q25 driven by an increase in consumer spending and a drop in imports. Net exports (the difference between exports and imports) added five percentage points to GDP after subtracting the most on record in the first quarter.

The Federal Reserve kept interest rates unchanged at their policy meeting (4.25%- 4.50%) in a 9-2 vote. It was the first time since 1993 that multiple governors cast ‘no’ votes on a rate decision. The post-meeting statement indicated, “economic activity moderated in the first half of the year and… [uncertainty] remains elevated.” In the post-meeting press conference, Powell reiterated, “restrictive stance [on policy] for now… no decisions made on the future yet.”

The Fed’s preferred inflation gauge, PCE Core, increased slightly more than expected in June (2.8% YoY vs. 2.7% YoY estimate). There were signs of tariffs making their way through goods prices, specifically durable goods, which increased at the fastest annualized pace since December 2022.

The U.S. economy added fewer jobs than expected in July (73K vs. 100K est.) and the previous two months (May and June) were revised lower (by 258K). The unemployment rate ticked higher to 4.2% and the labor force participation rate declined to 62.2%, the lowest since November 2022.

Weekly Market Recap — Global Equities Fall Amid Trade Uncertainty and Weak U.S. Economic Data

Equities:

The MSCI AC World Index was lower for the first time in three weeks as Trump’s August 1st tariff deadline came and tariffs rose for several key trading partners. All major U.S. equity averages were lower with small and midcap stocks falling the most. Large cap tech and growth sectors outperformed value sectors. Tech got a boost from strong 2Q25 earnings results from several key tech companies (e.g., Meta, Microsoft).

Fixed Income:

The Bloomberg Aggregate Index was higher for the second consecutive week as U.S. Treasury yields fell sharply amid trade uncertainty and a weaker than expected labor market report. All sectors of fixed income were higher, except for high yield corporate bonds. Investment grade corporate bonds and municipal bonds outperformed.

Commodities/FX:

The Bloomberg Commodity Index was lower for the second consecutive week. Copper prices fell more than 20% after President Trump excluded steep 50% tariffs on copper ore and concentrates, which surprised many investors. Natural gas prices were lower for the second straight week as U.S. stockpiles remained elevated.

WATCH NOW: Alternate View Podcast

Data is as of June 2025.

Source: FactSet Research Systems, Verdence Capital Advisors