Weekly Investment Insights

Preparing for Jackson Hole Symposium

Key Takeaways:

- Annual Federal Reserve Jackson Hole Symposium to take place this week.

- Over 120 distinguished guests are expected to attend the event.

- Headlines will likely be market moving.

- Labor market in focus given changing immigration dynamics.

- Do not expect Powell to commit to rate cut at September meeting.

Preparing for Jackson Hole Symposium

This week, the Federal Reserve will be in focus as their annual Economic Policy Symposium takes place in Jackson Hole, Wyoming. This year’s conference is titled, “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” The timely discussion comes amid decreasing confidence in federal employment data, highlighted by the firing of the former Bureau of Labor Statistics Commissioner and Trump’s public ridicule of Federal Reserve Chairman, Jerome Powell. In this Weekly Insights, we provide a deeper analysis of the importance of the annual conference and what investors can expect this week.

Purpose and history of Jackson Hole Symposium:

The Federal Reserve Bank of Kansas City has been hosting the Symposium since 1978. Each year, the bank chooses a timely, macroeconomic topic. Those invited to the symposium include economists, academics, and government representatives. The goal is to highlight long-term policy issues that can impact economies both domestically and globally.

Powell will need to manage expectations for rate cuts:

Chairman Powell is scheduled to speak at the conference on Saturday (Aug. 23). We expect him to try to temper expectations for the timing and magnitude of rate cuts. His tone and comments will be dissected by investors, especially with several U.S. equity indices near or at record highs. Interestingly, traders have thus far not been overly active in U.S. equity options ahead of the meeting (which are used to hedge portfolios). According to Citigroup, traders are expecting a muted S&P 500 move of +/- 0.67% during the week, less than the implied move following NVIDIA’s 2Q25 earnings (August 27) of +/- 0.83%.1

Labor market in focus:

The demographic shift in the U.S. labor market will be a key discussion point given the crack down on immigration. According to the National Foundation for American Policy, there was a drop-off of ~1.7 million foreign-born workers from March-July.2 Investors will look to comments on the long term impact of fewer foreign workers.

Look for comments on inflation:

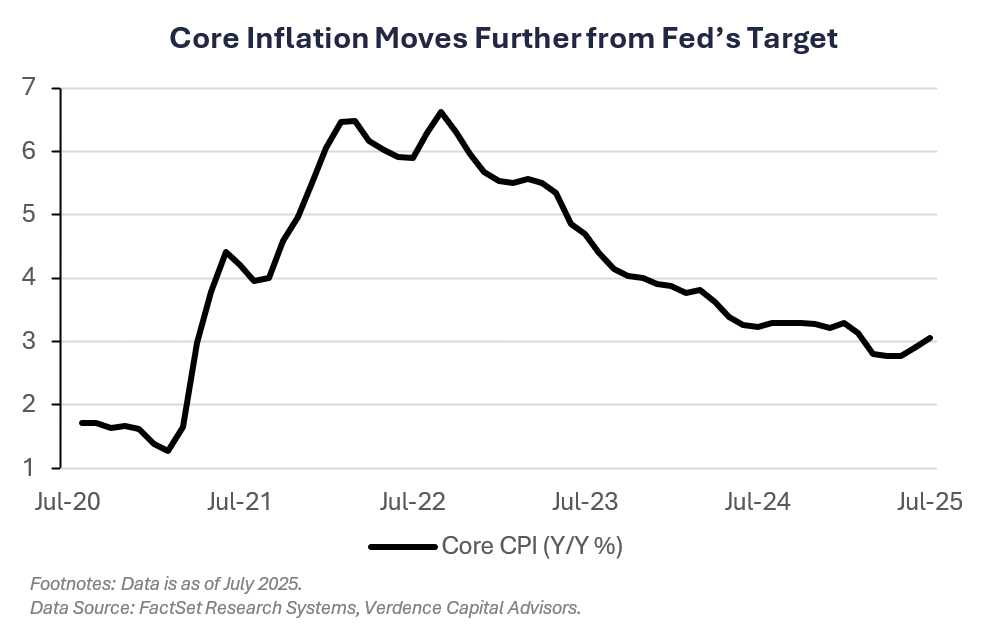

Last week, inflation readings from both the Consumer Price Index and Producer Price Index showed that progress on inflation is moving in the wrong direction. The PPI Index, which tracks the prices wholesalers are paying for goods, showed the sharpest monthly increase since June 2022 (+0.9% MoM). In addition, consumer prices (excluding food and energy) grew 3.1% (YoY), well above the Fed’s target and up from the 2.8% low seen in 1H25.

The Bottom Line:

Futures markets are pricing in an ~85% chance for a 25-bps interest rate cut at the Fed’s September meeting. While investors may be looking for confirmation from Fed Chairman Powell of a rate cut, we are not convinced he will deliver that to investors. The Fed will receive another labor market report, multiple inflation reports and consumer spending data before the September meeting. It may be too early for the Fed to have enough evidence that tariffs are not going to negatively impact inflation before they meet.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Core CPI increases at fastest rate since February.

- Producer prices surge by the most since June 2022.

- Consumer sentiment falls; inflation expectations climb.

- Small caps outperform on Fed rate cut expectations.

- Bond yields whipsawed by economic data.

- Commodities driven lower by energy and precious metals.

Weekly Economic Recap — Consumer Sentiment Deteriorates Amid Higher Inflation

In July, small business optimism as tracked by the NFIB increased to its highest level since February. Business owners grew more optimistic about the economic outlook. In fact, those that see a good time to expand rose to the highest level since January.

Headline inflation as tracked by the Consumer Price Index increased slightly less than expected in July (2.7% YoY vs. 2.8% YoY est.). The monthly rise in shelter prices accounted for the majority of the increase. Core prices, which exclude volatile food and energy prices, increased at the fastest annualized rate since February (3.1%).

Wholesale prices as tracked by the Producer Price Index increased more than expected in July (0.9% MoM vs. 0.2% est.). It was the largest monthly advance since June 2022. Excluding food and energy prices, the Core PPI measure, also increased 0.9% MoM, the most since March 2022. Services inflation was the largest contributor to the elevated readings.

READ MORE: Stock Market Seasonality

Consumers continued to spend in July as retail sales increased and June’s data was revised higher. The data showed a rush to buy electric vehicles ahead of the expiration of tax credits. In addition, online retail sales rose sharply after sales promotions from Amazon and Walmart.

Consumer sentiment broadly deteriorated in August according to the University of Michigan Sentiment Index. Year-ahead inflation expectations increased to 4.9% (from 4.5%), ending two consecutive months of receding. Buying conditions for durable goods fell 14% to its lowest reading in a year.

Weekly Market Recap — U.S. Small Caps Outperform as Expectations for Rate Cuts Rise

Equities:

The MSCI AC World Index was higher last week as economic data out of the U.S. fueled hopes for Fed rate cuts in September. Both the S&P 500 and Nasdaq notched record highs during the week before paring back some gains by Friday. However, it was small cap stocks that led the gains in the U.S. by posting their best performance in six weeks.

Fixed Income:

The Bloomberg Aggregate Index was relatively flat last week as bond yields were whipsawed by economic data. Short-term yields inched lower driven by increasing bets for Fed rate cuts. High yield and emerging market bonds outperformed Treasuries.

Commodities/FX:

The Bloomberg Commodity Index was lower for the third time in the last four weeks. Crude oil prices fell for the second straight week after President Trump announced plans to meet with Russian President Putin in Alaska, leading to expectations of the potential for easing of sanctions. Gold prices finished the week lower after a hotter-than-expected PPI inflation report.

WATCH NOW: Alternate View Podcast

Data is as of July 2025.

Source: FactSet Research Systems, Verdence Capital Advisors