Weekly Investment Insights

2Q25 Earnings Roundup

Key Takeaways:

- S&P 500 reporting better than expected year-over-year earnings growth for 2Q25.

- Technology/AI has led, but companies beating earnings estimates has been broad-based.

- Recessionary commentary plummets from prior quarter.

- Retailers surpassed expectations amid a resilient consumer.

- Optimism for 3Q25 earnings.

2Q25 Earnings Roundup

With 2Q25 earnings season coming to a close, ~80% of companies beat estimates on both earnings and revenue growth. The blended year-over-year earnings growth rate (includes estimates and those companies that have reported) is ~12%, which is above the 10-year average of ~9%.1 The growth rate is also higher today compared to the end of 1Q25 (+9% YoY est.). While tech and AI names contributed the most to earnings growth, companies across most sectors largely beat earnings estimates. This week, we provide some key takeaways from 2Q25 earnings season and what investors might watch for in 3Q25.

Recession crowd getting quiet

Equities were volatile in 2Q25 as companies and investors needed to contend with the uncertainty of tariffs and the implications for U.S. growth and inflation. Companies were expected to highlight this in 2Q25 earnings season but that was not the case. In fact, according to FactSet, the number of companies citing “recession” during earnings calls plummeted 87% compared to 1Q25. On a percentage basis, only four percent of earnings calls cited “recession.”

Retailers thrived this earnings season

Despite increased tariffs and an uncertain economic environment, retailers earnings were better than expected. Walmart insisted they are keeping prices as low as they can and there were “areas where [they] have fully absorbed the impact of tariffs,” according to John Rainey, CFO. In addition, Amazon reported that tariffs have not made a noticable impact on prices. Retailers confirmed consumers remained resilient in the face of uncertainty for much of the quarter. However, consumer cracks began to emerge toward the end of the quarter as more middle- and low-income shoppers shifted their spending patterns to necessities over wants.

Information technology driving earnings growth

The information technology sector has been the second largest contributor to overall earnings growth for 2Q25 (+21.5% YoY). Semiconductor companies led from an industry perspective. Many companies in this industry reported an increase in capital expenditure plans to build out AI capacity. NVIDIA reports earnings this week (Wednesday) and they will be monitored for their AI spending plans, along with how they are dealing with potential China tariffs.

The Bottom Line

Earnings growth for 2Q25 is impressive given the volatile stock market, highly uncertain tariff policy, an unstable geopolitical climate, rising inflation expectations and slowing economic growth. With ~80% of companies beating earnings estimates it is the best beat for an earnings season since 3Q23 (~81%), according to FactSet. We acknowledge the resilience of earnings but remember that 2Q25 earnings estimates were revised lower by ~5% between the end of 1Q25 and the end of 2Q25. As we look at 3Q25 earnings (season kicks off week of October 13th), we are concerned that expectations may be too optimistic. Earnings for 3Q25 are expected to grow 8.2% YoY in 3Q25 vs. 7.8% YoY at the end of the second quarter. This is the first time since 2Q24 that we have seen earnings estimates for a future quarter rise.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

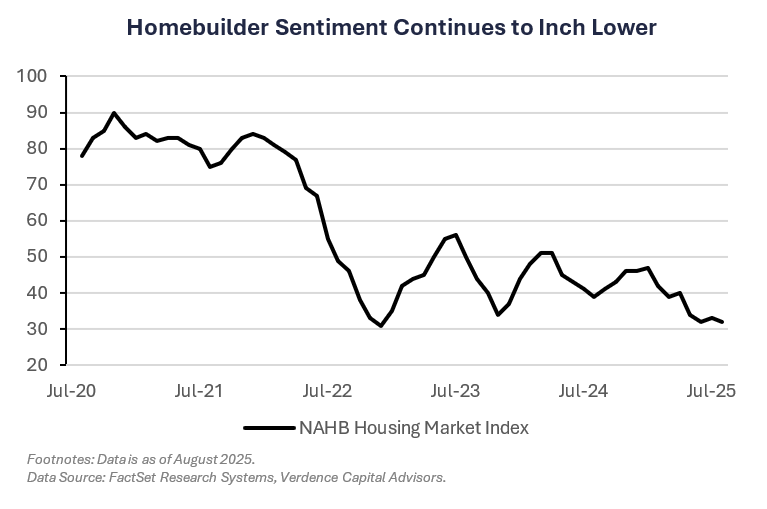

- Homebuilder confidence plummets to lowest since Nov. ’22.

- Fed divergence highlighted by FOMC July minutes.

- Manufacturing surprisingly expands.

- U.S. equities stage late-week rally on dovish Powell.

- Treasury yields fall as rate cut expectations rise.

- Commodities higher driven by energy and softs.

Weekly Economic Recap — FOMC Minutes Highlight Divergence of Opinions

Homebuilder confidence, as tracked by the NAHB, fell to its lowest level since November 2022 in August (32). The share of builders using sales incentives climbed to a post-pandemic high of 66% as homebuyers remain on the sidelines.

Housing starts in the U.S. climbed to a five-month high in July amid the strongest pace of multifamily construction starts since mid-2023. Starts of single-family homes, which make up the largest share of home construction, increased at an annualized rate of 939K (+2.8% MoM).

Building permits, a proxy for future home construction plans, decreased to its lowest annualized rate since June 2020 (1.35 million). Permits for multi-family homes led the broad weakness while single-family home permits increased for the first time since February.

The July FOMC meeting minutes emphasized the diverging opinions of committee members. The meeting was the first time in more than 30 years that more than one Fed Governor (2) dissented from the vote. Various participants “pointed to the uncertain effects of tariffs.” The Fed’s dual mandate (stable prices and maximum employment) was a topic of debate. The release stated, “a majority of participants judged the upside risk to inflation [was greater than] the downside risk to employment.”

Manufacturing as tracked by S&P Global expanded in August at the fastest rate since May 2022. The increase was led by higher factory output and backlogs, both of which increased to the highest levels since mid-2022. Employment witnessed the strongest growth since March 2022.

Weekly Market Recap — Global Equities Rally on Dovish Fed Tone at Jackson Hole

Equities:

The MSCI AC World Index was higher for the third consecutive week as investors cheered a dovish tone from Federal Reserve Chairman Jerome Powell, indicating rate cuts may be on the horizon. The S&P 500 posted four losing sessions to start the week, but the Friday surge in risk-on sentiment from investors helped the broad index finish the week modestly higher. Small-caps benefitted the most, posting their fifth positive week out of the past six weeks.

Fixed Income:

The Bloomberg Aggregate Index was higher as bond yields fell on the prospect of interest rate cuts from the Federal Reserve. All sectors of fixed income were higher as yields fell, with outperformance coming from U.S. TIPS and investment grade corporate bonds.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second time in three weeks. Crude oil prices were higher amid uncertainty surrounding peace talks between Ukraine and Russia. Soft commodities were also higher, driven by coffee prices, which were higher for the third straight week, amid weather concerns in Brazil and tight U.S. supplies.

WATCH NOW: Alternate View Podcast

Data is as of August 2025.

Source: FactSet Research Systems, Verdence Capital Advisors