Weekly Investment Insights

August 2025 Market Recap: Why Did Investors See Strong Returns?

Key Takeaways:

- Fed tone turns dovish at Jackson Hole Symposium.

- Inflation continues to move further above Fed’s 2% target.

- Global equities post longest winning streak since mid-2024.

- Treasury yields fall on expectations for Fed rate cuts.

- Commodities performance muted; coffee surges but energy declines.

August 2025 Market Recap – Strong End to Summer for Investors

August was a stellar month for investors as all asset classes rose and volatility (as measured by the VIX Index) dropped for the fourth consecutive month. While economic data was not something for investors to cheer about, the Fed’s insinuation that rate cuts are ahead supported equities, bonds and commodities. Equities defied the seasonal weakness typically seen in August as several equity indices hit fresh record highs (e.g., S&P 500, Nasdaq, FTSE 100). Bonds priced in a Fed rate cut with the two year Treasury yield dropping near a year to date low. Commodities also rallied on outperformance from softs. In this Weekly Insights, we give an August 2025 Market recap from an economic and asset class perspective.

- Fed Tone Turns Dovish: During his Jackson Hole Symposium speech, Fed chairman Powell stated, “…the shifting balance of risks may warrant adjusting [the committee’s] policy stance.” Investors took this as a signal of lower interest rates in September.

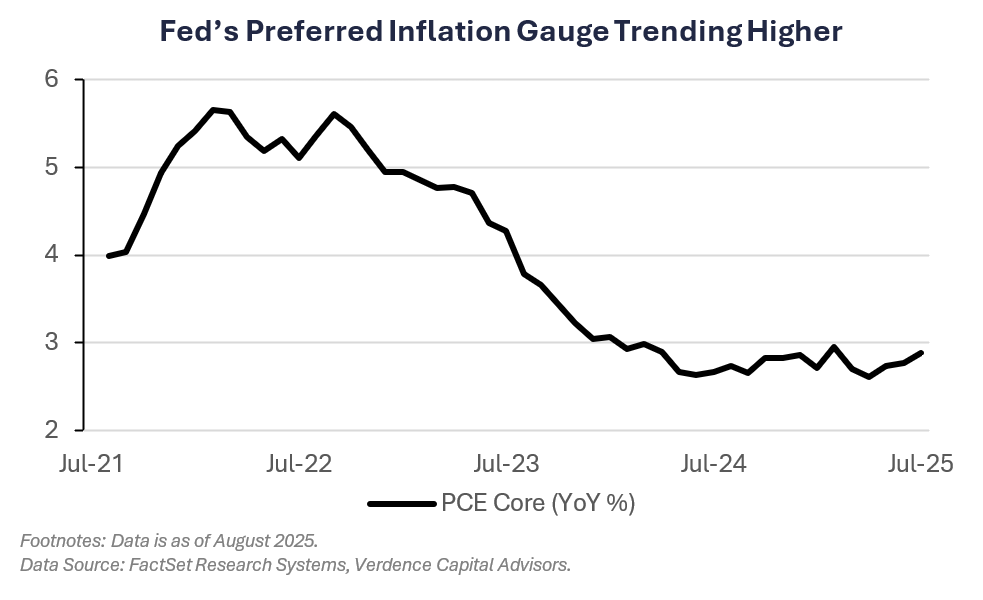

- Core Inflation Moving Higher: The core inflation readings (i.e., Core CPI and Core PCE) have both been moving away from the Fed’s 2% target. Both readings are now sitting at their highest levels since February (3.1% and 2.9%, respectively).

- Consumers Remain Resilient: Consumer spending remained resilient during the month supported by sales promotions.

- Mixed Housing Data: Building permits, a proxy for future home construction, decreased to the lowest annualized rate since 2020. However, construction of new homes increased to the highest level in five months.

Global Equities – Equities rally despite negative seasonality: The MSCI AC World Index rose for the fifth straight month in August, the longest winning streak since mid-2024.

- S. small caps drive performance: Small-caps as tracked by the Russell 2000 outperformed their large cap (S&P 500) peers by the most since June 2024. The outperformance came as optimism increased for lower interest rates, which are supportive of smaller companies.

- Developed markets outperform: The MSCI EAFE (developed markets) outperformed the MSCI Emerging Markets Index amid optimism for Fed rate cuts.

Fixed Income – Yields sharply lower: The Bloomberg Aggregate Index was higher as Treasury yields fell on expectations for Fed rate cuts.

- All fixed income sectors higher: All sectors of fixed income were higher in August. Outperformance came from U.S. TIPS as investors repriced inflation expectations.

Commodities – Mixed bag of performance: The Bloomberg Commodity Index was marginally higher in August as gains in softs outweighed the drop in energy.

- Softs lead gains: The Bloomberg Softs subindex was higher by the most since June 2016. Coffee rose the most since November 2024 on tighter supplies out of Brazil.

- Energy prices drop. The Bloomberg Energy subindex fell for the second month this year. Mild weather and the end of the summer driving season drove demand lower.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Consumer confidence falls on labor market concerns.

- Consumer spending resiliency supports economic growth.

- Fed’s preferred inflation gauge moves further from target.

- Global equities lower for first time in four weeks.

- Short-term yields fall amid Fed Governor uncertainty.

- Commodities higher driven by natural gas and gold.

Weekly Economic Recap — U.S. Economy Expands at Faster Pace; Inflation Still a Concern

Sales of new homes in the U.S. increased more than expected in July and June data was revised higher. The upside surprise was driven by easing prices and heavy incentives to entice prospective buyers. The median sales price of a new home fell 6% YoY in July to $403.8K, the lowest month of July since 2021.

The rise in home prices slowed for the fifth straight month in June, according to the S&P Cotality Index. The Index increased 1.9% from a year ago, the smallest gain since July 2023. New York, Chicago and Minneapolis were the only cities to see prices rise in June. Phoenix, San Francisco and Miami saw the biggest decline in home prices for the month.

Consumer confidence as measured by the Conference Board fell in August amid concerns around jobs and income. The share of consumers that said jobs were hard to get increased to the highest level since 2021. The present conditions gauge decreased to the lowest level since April.

The U.S. economy grew at a faster than expected pace in 2Q25 (3.3% vs. 3.1%). Consumer spending led the upward revision (+1.6% QoQ vs. +1.4% in first reading). Final sales to private domestic purchasers, a closely watched metric by the Fed as an indication of demand/sales within the U.S., increased more than expected. Net exports (i.e., the difference between exports and imports) contributed ~5% to the Q2 total.

The Fed’s preferred inflation gauge, PCE Core, rose 2.9% YoY, the highest annual rate since February. The headline reading (including all components) increased 2.6% YoY and was driven by stubborn service prices (+3.6% YoY).

Weekly Market Recap — Global Equities Fall Driven by Uncertainty in the U.S.

Equities:

The MSCI AC World Index was lower for the first time in four weeks as investors took profits after a strong earnings season. In addition, investors grew nerrvous about Trump’s attempts to remove a Fed Governor (Lisa Cook). The major U.S. averages finished the week modestly lower with the exception of the small-cap Russell 2000. Small-caps were higher for the fourth straight week and outperformed the S&P 500 for the third consecutive week.

Fixed Income:

The Bloomberg Aggregate Index was higher as the Treasury yield curve steepened (short and intermediate term yields fell more than long term yields) after Trump’s announcement to remove Fed Governor Lisa Cook. All sectors of fixed income finished in positive territory, with the exception of investment grade corporate bonds.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second consecutive week. Natural gas prices were higher for the first time in six weeks on tighter U.S. supplies and a mixed weather forecast. Gold prices were higher for the fourth time in five weeks amid increased expectations for a Fed rate cut.

WATCH NOW: Alternate View Podcast

Data is as of August 2025.

Source: FactSet Research Systems, Verdence Capital Advisors