Weekly Investment Insights

Addressing Causes of Recent Market Volatility

Key Takeaways:

- Volatility picks up in U.S. markets.

- Economic outlook cloudy.

- Inflation a stubborn issue.

- A valuation correction was overdue.

- Political uncertainty contributing to mixed outlook.

Addressing Causes of Recent Market Volatility

Last week was a challenging week for U.S. equity investors. The Dow Jones Industrial Average posted two back to back days of a 1% or more decline for the first time in six months. The S&P 500 hit a record high and retreated. The Russell 2000 and 2500 Index turned negative year to date and volatility as measured by the VIX Index saw its biggest weekly jump this year. In this weekly, we outline the reasons behind the recent volatility and what we expect going forward.

- Economic data: Several key economic reports have come in weak. The housing market continues to be challenged by high rates and thin inventories. Leading indicators have turned negative. Consumer confidence has fallen sharply. Retail sales dropped in January and consumers are increasingly worried about the inflation trajectory.

- Earnings downgrades: Walmart fueled the late week sell off after warning about consumer behavior and revising guidance for 2025 earnings lower. In fact, the S&P 500 consensus 2025 earnings estimate has fallen from $272 to $269 since year end 2024.

- Seasonality: Seasonality may also play a part in equity weakness. Going back to 1945, February has been the second worst month for equity performance (behind September) and only positive ~50% of the time. The average decline in year one of the Presidential term is even worse (-1.1% vs. -0.2%).

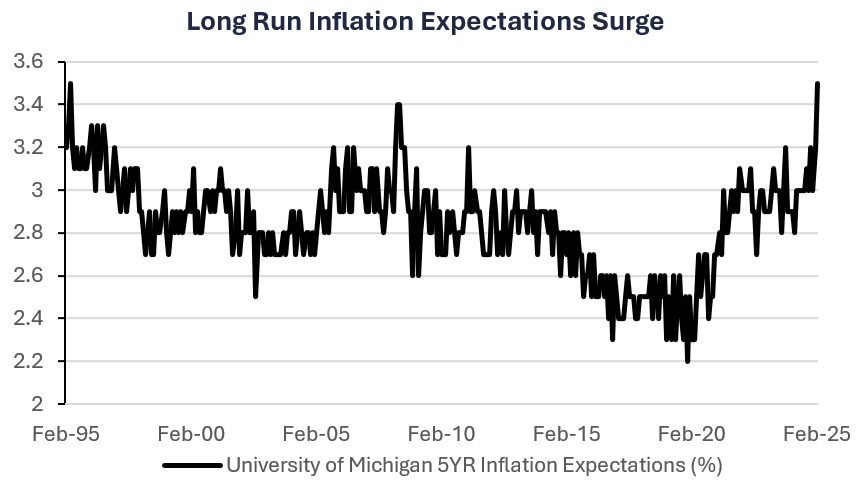

- Inflation fear: The Fed confirmed their concern with the progress on inflation in their Meeting Minutes last week. In addition, consumers are increasingly concerned with inflation as seen by long-term inflation expectations jumping to the highest level since 1995 (per U. of Michigan Survey).

- Valuations: As we entered 2025, U.S. equity valuations (P/E multiple) were pricing in a perfect economic soft landing, a seamless Trump transition, Fed rate cuts and double-digit earnings growth. This optimism is fading as earnings are being revised lower, the economy is slowing, and inflation keeps the Fed on the sideline. Aside from the brief spike around the pandemic, last week the forward PE for the S&P 500 touched the highest level since the dotcom bubble.

- Political uncertainty: Trump’s swift moves to start delivering on his campaign promises have contributed to the uncertainty for consumers, investors and businesses. According to the Federal Register, President Trump has signed ~70 executive orders in his first month in office, more than any other President this early in his term. In addition, efforts from the DOGE committee are fueling concern over economic growth.

The Bottom Line:

Economic data has highlighted our view of a slowdown in growth in 1H25, especially the consumer. In addition, the Fed is likely to remain on hold through 1H25 at least. Equities are resetting valuations to reflect these changing dynamics. Typically when this happens, volatility increases and opportunities can arise. We still think there is more downside in the near term to U.S. large cap stocks as realism on the economic and earnings trajectory starts to overshadow momentum and the fear of missing out.

WATCH NOW: Rethinking Structured Real Estate

Your Economic and Market Detailed Recaps

- Homebuilder sentiment falls to a five-month low.

- Fed keeps rates unchanged until progress on inflation.

- Consumer confidence plummets.

- S. equities weigh on global performance; China tech higher.

- Bonds gain on weak economic data.

Weekly Economic Recap — Housing still struggling; Fed on hold

Homebuilder sentiment according to the National Association of Homebulders fell to a five month low in February. Concerns over high mortgage rates and tariffs led the Index lower. The expectations gauge posted its largest drop since the start of the Covid pandemic (-13 pts.). Confidence dropped among builders across all four U.S. regions, but confidence among builders in the Northeast fell by the most since April 2020.

Housing starts slowed in January as builders grow concerned over mortgage rates and material costs. Construction fell 9.8% from the prior month to an annualized pace of ~1.37 million homes.

The minutes from the Federal Reserve’s January meeting indicated the overwhelming support to keep policy rates unchanged until further progress on inflation is seen. Members continue to see upside risks to the inflation outlook, citing “the possible effects of potential changes in trade and immigration policy.” The minutes also indicated “firms would attempt to pass on to consumers higher input costs arising from potential tariffs.”

The final reading on February’s University of Michigan Consumer Sentiment Index showed confidence fell for the second consecutive month and dropped to a 15 month low. Confidence on the current economic conditions and future expectations on the economy declined. The expectations component fell at the fastest rate since October 2023. In addition, long term inflation expectations (5-10 years) rose to the highest level since April 1995.

LISTEN IN: Markets With Megan Podcast

Weekly Market Recap — U.S. Equities Underperform Global Counterparts on Tariff Fears and Geopolitical Uncertainty

Equities: The MSCI AC World Index was lower for the first time in three weeks. Investors digested the latest round of tariff rhetoric from President Trump as well as geopolitical headlines as he attempts to end the war in Ukraine. Emerging markets outperformed developed markets led by Chinese tech earnings, which came in better-than-expected. Major averages in the U.S. were lower as investors digested the latest Fed meeting minutes and sentiment broadly declined.

Fixed Income: The Bloomberg Aggregate Index was higher for the sixth straight week. Investors parsed through the lasted Fed commentary, as well as disappointing economic data which sent yields lower (prices higher). All the major sectors rose for the week but high yield was flat.

Commodities/FX: The Bloomberg Commodity Index was higher for the third straight week. Gold prices continued to carry commodity performance as investors flock to safe-haven assets amid geopolitical and tariff uncertainty. Natural gas prices were higher for the second straight week on increased demand given extreme cold weather in the U.S.

Data is as of February 2025.

Source: FactSet Research Systems, Verdence Capital Advisors