Weekly Investment Insights

April 2025 Market Recap – April Storm for the U.S.

Key Takeaways:

- U.S. GDP contracts for first time since 2022.

- U.S. labor market remains resilient.

- U.S. equities lag the rest of the world.

- Central banks to be challenged amid trade tensions.

- Commodities weaker on demand expectations.

April 2025 Market Recap – April Storm for the U.S.

Last week, the International Monetary Fund (IMF) slashed 2025 global growth forecasts to 2.8% (from 3.3% estimate in January). It’s well below the historical (2000 – 2019) average of 3.7%.1 This would mark the slowest expansion of global GDP since the Covid pandemic (in 2020). According to the report, the revision lower was attributed to “a greater amount of policy uncertainty, trade tensions, and expected softer demand momentum.” Global headline inflation is expected to moderate to 4.3% in 2025. Which is slightly higher than the 4.2% estimate from January. This week, we dive deeper into the IMF report and highlight key factors that caused the downgrade in growth.

LISTEN NOW: Markets With Megan Podcast

The April storm that blanketed U.S. equity markets began on “Liberation Day” (April 2). Trump’s aggressive plan for tariffs sent volatility as measured by the VIX Index to levels not seen since the COVID pandemic. The uncertainty spread to Treasuries with the 10YR U.S. Treasury yield rising 50 bps in a week and the U.S. Dollar fell to the lowest level since March 2022. President Trump put a pause on tariffs but the damage was seen in confidence about the future of the U.S. economy. In this weekly insights, we offer an overview of the month of April from an economic and asset class perspective.

- U.S. GDP contracts: The first reading of 1Q25 GDP showed the U.S. economy declined for the first time since 2022 due to a surge in imports. In addition, consumer spending grew at the slowest pace in seven quarters.

- Labor market resilient: The U.S. economy added 177K jobs in April and the unemployment rate remained unchanged (at 4.2%).

- Inflation moderates. Inflation as measured by the Consumer Price Index declined for the first time since 2022. At the core level (ex food and energy) the rise in prices slowed on a year over year basis (to 2.4% from 2.8%).

- Consumers getting ahead of tariffs. Retail sales rose at the fastest pace since January 2023 as consumers rushed to purchase items that may be subject to tariffs (e.g., autos, building materials).

Global Equities – Late month turnaround:

Despite declining more than 10% in the week following “Liberation Day,” the MSCI AC World Index recouped all those losses by month end.

- U.S. lags the rest of the world: U.S. equities lagged the rest of the world as tariff uncertainty sent the S&P 500 into correction territory (drop of 10% or more) and small and midcap stocks into bear market territory (drop of 20% or more). The MSCI AC World Index excluding the U.S. rallied for the third time in the past four months.

- Small caps underperform: The Russell 2000 Index lagged the Russell 1000 Index for the fifth consecutive month as tariffs raise the odds of a recession.

Fixed Income – Investors flock to safety:

The Bloomberg Aggregate Index was higher for the fourth straight month, and by the most since December 2023 as yields fell during the month.

- Repricing inflation expectations: US TIPS and floating rate instruments led performance for the asset class as investors reprice inflation expectations.

- Municipal bonds underperform: Municipal bonds fell for the second straight month amid higher issuance and increased selling to fund tax payments.

Commodities – Recession risk hits commodities:

The Bloomberg Commodity Index declined by the most since May 2023 as Trump’s tariff announcement raises the risk of a recession in the U.S.

- Energy leads the weakness: The Bloomberg Commodity Energy Index fell by the most since September 2022.

- Gold rallies: Gold prices hit a new record high due to the flight to safety, weakness in the dollar and volatility in equities.

Your Economic and Market Detailed Recaps

- Home price gains moderating.

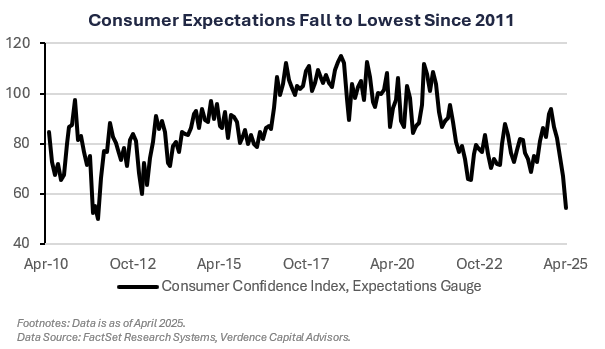

- Consumer confidence continues to weaken.

- Labor market resilient despite uncertainty.

- Global equites higher again; U.S. tech leads rally.

- Yields whipsawed by economic data.

- Commodities lower driven by softs underperformance.

Weekly Economic Recap — Consumer Confidence Falls Further While Labor Market is Resilient.

Home prices as measured by the S&P CoreLogic Index rose 0.4% in February while the year over year gains moderated from the prior month (4.5% vs. 4.7%). The monthly gains were led by Boston, New York and Washington DC. The only regions to see prices drop were San Francisco and Cleveland.

Job openings as measured by the monthly JOLTS report showed job openings dropped to the lowest level in five months (7.19 million). The quits rate, those leaving their jobs voluntarily, rose to an eight month high.

Consumer confidence as measured by the Conference Board fell to the lowest level since January 2021 in March. The expectations component fell to the lowest level since 2011. One year ahead inflation expectations rose to the highest level since 2022 (7.0%).

The ISM Manufacturing Index showed that manufacturing dipped further into contraction territory in April (a reading below 50). The weakness was led by production, new export orders and imports. Prices paid, an inflation indicator, rose for the fifth consecutive month to the highest level since 2022.

LISTEN IN: Alternate View Podcast

The U.S. economy added more jobs than expected in April (177K vs. 138K estimate). However, the prior two months saw 58K jobs fewer than originally reported. The unemployment rate remained unchanged at 4.2%. The healthcare sector led the job gains along with trade jobs. Federal government jobs dropped for the third consecutive month. Average hourly earnings rose slightly less than expected (0.2% MoM vs. 0.3% estimate). As a result, earnings are growing 3.8% on an annual basis.

Weekly Market Recap — Global Equities Surge on Easing Trade Tensions; Tech Leads Rally

Equities:

The MSCI AC World Index was higher for the fourth straight week as global trade tensions continued to ease. The returns were broad based with all the major regions higher for the week. Within the U.S. equity market, the S&P 500 recouped all the losses from April’s “Liberation Day.” In addition, growth outperformed value as mega-cap tech earnings were better-than-expected. Small caps as tracked by the Russell 2000 also rallied and were higher for the fourth straight week.

Fixed Income:

The Bloomberg Aggregate Index was modestly lower last week as yields fluctuated from a plethora of economic data, including GDP data that showed a contracting U.S. economy in 1Q25, and a better-than-expected jobs report. Municipal bonds led the rally in fixed income and were higher for the third straight week.

Commodities/FX:

The Bloomberg Commodity Index was lower for the second consecutive week. Soft commodities led weakness, driven by sugar futures, on increased supply prospects. Crude oil prices plummeted on reports OPEC+ would be deliberating on increasing oil output. Gold prices fell for the second consecutive week on easing global trade tensions and better-than-expected labor market data.

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors