Weekly Investment Insights

Initial Take on U.S. Bombing Iran Nuclear Facilities

Key Takeaways:

- U.S. takes surprising approach to halt Iran nuclear capability.

- Markets shrug off impact of U.S. actions.

- History suggests weakness presents buying opportunities.

- Watching Iran’s response towards the U.S. closely.

- Not complacent despite markets reaction.

Initial Take on U.S. Bombing Iran Nuclear Facilities

In this Weekly Insights, we want to address the events that unfolded over the weekend with the U.S. bombing of Iran’s nuclear facilities. In this early stage, we admit there are a lot more unknowns than knowns. We also realize that we are market specialists not political experts. Therefore, we will focus on what we know at this point and focus on the long term. Especially since history has proven that markets tend to overreact to geopolitic events and present opportunities for long term investors.

Why the escalation now?

- Iran has consistently breached the International Atomic Energy Agency’s (IAEA) restrictions. The Trump Administration has attempted to negotiate with Iran without success. Recently, the IAEA said that Tehran had stockpiled uranium to 60% purity on its way to 90% which would be weapons grade.1

What we know now?

- In the aftermath of the U.S. bombing three Iran nuclear sites, Iran has responded with additional missle attacks on Israel. There have been threats from Iran towards the U.S. but so far the retaliation has been isolated to Israel. The damage to the three sites and whether nuclear supplies were moved ahead of the strike is still being debated. However, initial findings suggest it has severely disabled Iran’s nuclear program.

Market reaction?

- Thus far, the market reaction has been muted. While oil prices surged in the overnight futures market, they have since dropped as supply appears not to be at imminent risk. Equities are slightly higher while safety assets like Treasuries and Gold are also higher. Volatility as measured by the VIX Index is subdued, rising modestly (to 20) but well below the year to date peak we saw during the “Liberation Day” volatility (52).

Comparison to prior military actions:

- According to Strategas Research, the S&P 500 performs well in the aftermath of major U.S. military actions. They compared 10 different military events (e.g. Pearl Harbor, the Gulf War, Libya in 2011). According to their research, the S&P 500 is higher ~8% on average in the 12 months after a military action and was positive 80% of the time.

Risks monitoring:

- The immediate risk is that Iran uses the Strait of Hormuz. According to the U.S. Energy Information Administration, the Strait moves ~1/5 of the daily global oil production and Iran controls a portion of the Strait. Shutting this down would cause supply disruptions and send oil prices higher.

The Bottom Line

We are watching developments closely. While there are opinions on both sides of the aisle about the approach, most global leaders agree that the world is a safer place without Iran having nuclear capabilities. The market reaction shows that investors may be getting immune to ongoing geopolitical events. However, we are not complacent. We are not recommending any changes to asset allocation currently as we have a long-term time horizon. Instead, we will look for opportunities upon market weakness. The Fed’s path will be highly dependent on the price of oil and how that impacts inflation. At this time, we are still expecting a September rate cut but it is highly dependent on the path of inflation.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Retail sales mark first back-to-back decline since 2023.

- Fed keeps rates unchanged, signals uncertainty.

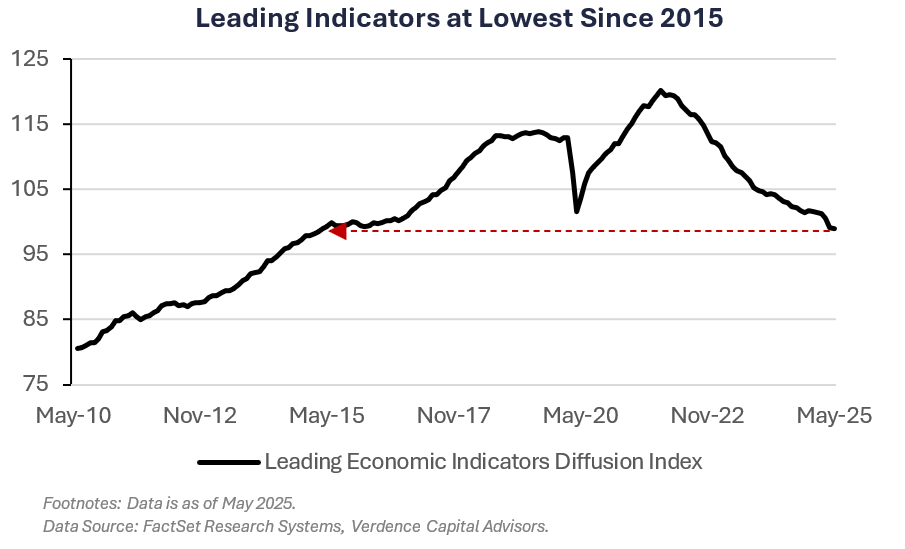

- Leading Indicators Index falls to lowest level since 2015.

- Equities lower as investors weigh geopolitical tensions.

- Bond yields fall as investors digest Fed commentary.

- Commodities rally driven by energy outperformance.

Weekly Economic Recap — Fed Keeps Rates Unchanged as Uncertainty Remains Elevated

U.S. retail sales, which are not adjusted for inflation, decreased the most since the start of the year (-0.9%) and April’s value was downwardly revised to -0.1%, marking the first back-to-back decline since the end of 2023. Spending at restaurants and bars, a main service-sector category, fell by the most since 2023. The control group, which feeds into the calculation for GDP, increased 0.4% in May supported by gains in sporting goods and furniture, specifically.

Homebuilder confidence as tracked by the NAHB fell to the lowest level since December 2022 in June. All three components of the NAHB Housing Market Index declined, with a measure of present sales falling to the lowest since 2012. Prospective buyers’ traffic declined as potential buyers contend with higher mortgage rates.

The Federal Reserve kept interest rates unchanged at their June meeting (4.25% – 4.50%). The post-meeting statement of note was “uncertainty about the economic outlook has diminished but remains elevated.” The Summary of Economic Projections (SEP) indicated committee members increased their estimates for PCE Core inflation to 3.1% this year (from 2.8%) and lowered their estimates for GDP growth to 1.4% (from 1.7%).

The Leading Economic Indicators index declined further in May to the lowest reading since April 2015 (99). The decline was led by weak manufacturing new orders, rising initial claims for unemployment, and declining consumer expectations. Rising stock prices after a steep selloff in April was the main positive contributor.

Weekly Market Recap — Global Equities Lower as Investors Digest Geopolitical Turmoil

Equities:

The MSCI AC World Index was lower for the second straight week amid rising geopolitical tensions in the Middle East. In the U.S., major averages were mixed. Outperformance came from SMID cap equities and tech (i.e., Russell 2000 and Nasdaq). The S&P 500 finished marginally lower for the second straight week as investors digested the latest developments from the Federal Reserve. Developed markets broadly underperformed emerging markets as investors weighed rising tensions in the Middle East.

Fixed Income:

The Bloomberg Aggregate Index was higher for the second consecutive week as investors bought bonds in response to geopolitical tensions and the latest developments from the Fed (bond prices and yields move in opposite directions). All sectors of fixed income were higher. U.S. TIPS outperformed as investors reprice inflation expectations.

Commodities/FX:

The Bloomberg Commodity Index was higher for the third straight week. Energy outperformed other areas of commodities. Crude oil prices were higher for the third straight week on Middle East tensions and what it could mean for global oil supply. Natural gas prices surged on expectations for severe heat in the U.S. driving demand. Grain prices faltered on weather expectations.

WATCH NOW: Alternate View Podcast

Data is as of May 2025.

Source: FactSet Research Systems, Verdence Capital Advisors