Weekly Investment Insights

Global Markets Plummet on Economic Growth Fears

Key Takeaways:

- Labor market cracks getting bigger.

- Consumer sentiment quickly deteriorating.

- S. equities underperform global peers by most since 4Q12.

- Bond yields tumble, sending bond prices higher.

- Investors flock to safe-haven assets amid geopolitical uncertainty.

- Economic Growth Fears

Global Markets Plummet on Economic Growth Fears – 1Q25 Recap

Geopolitical tensions and weaker than expected economic data caused volatility to surge in the first quarter of 2025. U.S. equity markets tumbled as the mega-cap tech trade lost steam, dragging major averages lower. Treasury yields plummeted as investors flocked to safety amid increased recession fears. Commodities were led higher by a record quarter for safe-haven gold prices. This week, we recap the first quarter from an economic and asset class perspective.

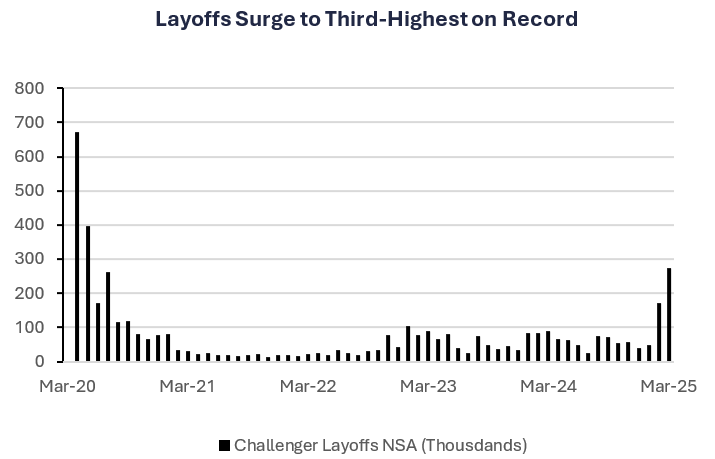

- Labor market cracks getting bigger: The unemployment rate in the U.S. increased 0.2% since the beginning of the year (to 4.2%) and layoffs have surged, driven by the federal government.

- Inflation remains a headwind: The Fed’s preferred inflation gauge, PCE Core, remains above the 2% target level set by the Federal Reserve. Services inflation remains the leading culprit of higher prices driven by shelter and transportation costs.

- Manufacturing back in contraction; services slowing: The ISM Manufacturing index fell back into contraction territory (a reading below 50) as higher prices weigh on activity. A gauge of the services sector, which accounts for more than two-thirds of the economy, fell to a nine-month low.

- Consumer sentiment plummets: Consumer confidence, as tracked by the Conference Board, reached the lowest level since January 2021 (92.9). Expectations over the next six months fell to the lowest level in 12 years amid the uncertainty about the economic consequences of tariffs.

WATCH NOW: Impact Report: Liberation Day Facts

Global Equities – U.S. lags international peers: The MSCI AC World Index was lower for the quarter, driven by underperformance from U.S. equities.

- “Mag” 7 lead US selloff: All seven “Magnificent 7” components (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) finished 1Q25 lower. All companies, except for Meta, were lower by more than 10%.

- The great rotation: The Russell 1000 Value Index outperformed the Russell 1000 Growth Index by the most since 1Q01. The outperformance was led by the energy, healthcare, and consumer staples sectors. Consumer discretionary and information technology finished the quarter in correction territory (a loss of at least 10% from the high).

- Developed international outperforms: The MSCI EAFE Index outperformed the S&P 500 by the most since 3Q02. European markets led performance driven by German equities.

Fixed Income – Bond yields tumble: The Bloomberg Aggregate Index rallied to start the year as investors displayed a flight to quality.

- Sectors rally except for municipals: All sectors of fixed income were higher, except for municipal bonds. US. TIPS led the rally as inflation risks increased.

Commodities: The Bloomberg Commodity Index posted its best quarterly return since 1Q22.

- Gold rallies: Gold prices surged the most since 3Q86 as invesors sought out the safe haven asset amid geopolitical uncertainty.

Your Economic and Market Detailed Recaps

- Consumer confidence falls to lowest since 2021.

- S. economy grows more than expected in 4Q24.

- Core inflation remains sticky.

- Fresh tariff measures rattle global equity markets.

- Treasury yields struggle for direction.

- Precious metals rally as investors flock to safe havens.

Weekly Economic Recap — Labor Market Showing Signs of Bigger Cracks

Manufacturing activity slipped back into contraction territory (a reading below 50) for the first time this year. The new orders and employment components fell the most. The prices paid component rose to the highest level since June 2022.

U.S. services activity, as measured by the ISM Services Index, expanded at the slowest pace in nine months in March. The employment index registered its largest monthly drop since 2020 (7.7 points), bringing the gauge to its lowest reading since 2023. Orders remained in expansion territory (a reading above 50), but fell on a monthly basis.

Job openings decreased in February to 7.57 million attributed to declines in retail trade, financial activities, and accommodation/food services. The quits rate (those who leave their jobs voluntarily) was unchaged at 2%. Federal employee layoffs increased to the highest since 2010 amid the White House layoffs.

LISTEN IN: Alternate View Podcast

Layoffs surged nearly 205% from a year ago to 275.2k in March according to the Challenger Job Cuts announcements. This marks the third-highest monthly total (only trailing April and May 2020) since Challenger began reporting job-cut plans in 1989. The increase was attributed to announced DOGE layoff plans as furloughs in the federal government climbed to 216K.

The U.S. economy added more jobs than expected in March and downward revisions over the previous two months were modest. The unemployment rate increased slightly to 4.2% (from 4.1%). The share of employed individuals holding multiple jobs increased to the highest level since 2009.

Weekly Market Recap — Global Equities Plunge on Trump’s Tariff Announcements

Equities: The MSCI AC World Index posted its worst weekly loss since the height of the Covid pandemic (March 2020) as Trump’s announced tariff plans were higher than feared. The U.S. led the weakness. The Dow Jones Industrial Average posted two consecutive days of losses greater than 1,500 points for the first time ever. The tech-heavy Nasdaq entered bear market territory, now lower by more than 20% from its December high.

Fixed Income: The Bloomberg Aggregate Index was higher for the third straight week as Treasury yields fell sharply on recession fears (bond prices higher). The U.S. 10YR yield fell ~25 basis points to close the week at ~4% as investors sought out quality in the face of growth fears. High yield corporate bonds underperformed higher quality areas of credit.

Commodities/FX: The Bloomberg Commodity Index was lower by the most since June 2022. Crude oil prices fell on recession fears sparked by Trump’s tariff plans. Gold prices fell for the first time in five weeks as investors sold the safe-haven to cover losses in other areas of the market.

Data is as of March 2025.

Source: FactSet Research Systems, Verdence Capital Advisors