Weekly Investment Insights

Economic Growth Forecasts Slashed

Key Takeaways:

- IMF cuts global economic growth forecast citing global trade tensions.

- S. sees 0.9% cut to 2025 GDP estimate from January.

- Eurozone sees smaller cuts supported by economic growth in Spain.

- Central banks to be challenged amid trade tensions.

- Clear and concise negotiations will be beneficial to growth.

Economic Growth Forecasts Slashed

Last week, the International Monetary Fund (IMF) slashed 2025 global growth forecasts to 2.8% (from 3.3% estimate in January). It’s well below the historical (2000 – 2019) average of 3.7%.1 This would mark the slowest expansion of global GDP since the Covid pandemic (in 2020). According to the report, the revision lower was attributed to “a greater amount of policy uncertainty, trade tensions, and expected softer demand momentum.” Global headline inflation is expected to moderate to 4.3% in 2025. Which is slightly higher than the 4.2% estimate from January. This week, we dive deeper into the IMF report and highlight key factors that caused the downgrade in growth.

- Tariffs driving the growth downgrade: The IMF’s World Economic Outlook cited, “[an] escalation of trade tensions and extremely high levels of policy uncertainty are expected to have a significant impact on global economic activity.” If the “Liberation Day” tariffs were excluded from the analysis, global growth would have only been cut by 0.2% to 3.2% in 2025.

- S. downward revisions: U.S. GDP is expected to grow 1.8% in 2025, a 0.9% reduction from the estimate in January. In addition to trade uncertainty, the IMF added consumer and business sentiment in the U.S. has been more pessimistic. While the organization is not calling for a recession specifically in the U.S., IMF chief economist Pierre-Olivier Gourichas told reporters the IMF views recession odds at 40% (revised up from 25% in Oct. 2024). Inflation expectations increased by 1.0% for 2025 from the January report to 3.0%. The increase signifies a full percentage point above the Federal Reserve’s target as well.

- Eurozone sees smaller downward revisions: The IMF forecast Euro area GDP would slow to 0.8% in 2025, only 0.2% below the January estimate. A potential increase in real wage growth and more public spending in Germany may be pillars of strength for the region. Spain is expected to grow 2.5% in 2025, the most of all EU countries, bolstered by increased trading capabilities with Eastern European countries.2

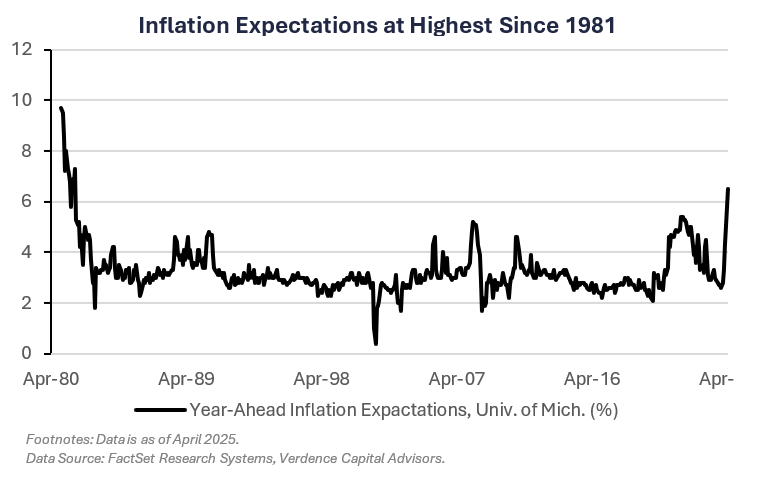

- Central bank challenges: Monetary policy faces many challenges in the year(s) to come, specifically from trade disputes and potential supply-chain disruptions. Inflation expectations have surged, especially in the U.S., forcing the Federal Reserve to weigh their dual mandate of maximum employment and stable prices. The IMF stated, “credibility of the monetary policy framework… and central bank independence, will remain key.”

The Bottom Line:

We agree the global economy faces many challenges, especially with the uncertainty around fiscal, trade and monetary policy. The trade tensions have the potential to hurt U.S. growth prospects in the near-term. And also force countries to work more constructively to achieve a stable and predictable trade environment. We think volatility in equity markets can continue and be driven by the regular headlines about trade negotiations (both good and bad). For long term investors, weakness should be viewed as potential buying opportunities.

Your Economic and Market Detailed Recaps

- Leading indicators continue to fall.

- Durable goods sales surge ahead of tariffs.

- Consumer sentiment at fourth lowest reading in history.

- S. equities lead global performance; tech higher.

- Bond prices rally on fears of economic slowdown.

- Commodities lower, softs outperform.

Weekly Economic Recap — Consumer Sentiment Remains Historically Low

The Leading Economic Indicators Index fell more than expected in March (-0.7% vs. -0.5% est.). Three components, specifically consumer expectations, stock prices, and new manufacturing orders, were the largest detractors from the index as economic uncertainty jumped.

U.S. business activity slowed to a 16-month low in April according to the preliminary flash PMI reading from S&P Global. Prices charged for goods and services increased at the highest rate in over a year. Manufactured goods linked to tariffs were a leading culprit of price increases. Sentiment among companies about their output over the coming year fell for a third consecutive month, falling to the lowest level since July 2022.

Sales of durable goods (i.e., items meant to last at least three years) surged by the most since July as buyers look to get ahead of tariffs. The increase was led by a 139% increase in nondefense aircraft and parts.

Sales of existing homes in March fell at the fastest monthly pace since November 2022, despite an increase in listings, which were up ~20% from a year ago. Elevated mortgage rates dampened buyer demand. Sales across all regions were lower from February, driven by a sharp decline in the West.

LISTEN IN: Alternate View Podcast

Consumer sentiment fell to its fourth lowest reading in history (52.2) according to the University of Michigan Sentiment Index. Year-ahead inflation expectations sit at 6.5%, the highest since 1981. The expectations gauge fell to the lowest level since 2022 and consumers expected weaker income growth for themselves in the year ahead.

Weekly Market Recap — Global Equities Rally as Trade Tensions Ease; Growth Outperforms

Equities: The MSCI AC World Index was higher for the third straight week supported by reports of trade tensions easing between the U.S. and China. Technology/growth areas of the U.S. market outperformed on the positive trade developments. The tech-heavy Nasdaq led gains, followed by the S&P 500. Small-caps, as tracked by the Russell 2000, were higher for the third straight week.

Fixed Income: The Bloomberg Aggregate Index was higher for the second straight week. Yields on longer-dated maturies fell the most (bond prices higher) on fears of an economic slowdown. All sectors of fixed income markets were higher.

Commodities/FX: The Bloomberg Commodity Index was lower for the first time in three weeks. Crude oil prices were lower on the back of oversupply concerns and continued uncertainty around global tariff negotiations. Gold prices were lower as trade tensions eased. Softs commodities (i.e., agriculture products and livestock) outperformed. However, led by coffee futures on weather and transportation concerns.

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors