Weekly Investment Insights

Is the Inflation Worry Over?

Key Takeaways:

- Federal Reserve set to cut rates this week.

- Signs that some of the tariff impact is being absorbed by companies.

- Inflation improving but many warning signs within consumer prices.

- Rate cuts are priced into S&P 500, near term downside risks rising.

- Fed must not get complacent on inflation.

Is the Inflation Worry Over?

Last week the Federal Reserve received the final reports on inflation before they meet Tuesday and Wednesday to decide the path of interest rate policy. The data suggested that tariffs have not (yet) had a meaningful impact on prices and companies are bearing some of the burden. In addition, the Bureau of Labor Statistics reported that the labor market was weaker than originally reported during the period of April 2024-March 2025. As a result, the Fed funds futures market is pricing in ~100% chance of a 25 bps rate cut and a ~10% chance of a 50 bps cut.

The recent data suggests an interest rate cut is necessary. However, the Fed’s stance on the pace and magnitude of future cuts will be closely monitored, and likely market moving, when they release their quarterly dot plots. This is especially important since inflation remains above the Fed’s target and by several metrics has been trending higher in recent months.

In this weekly insights, we summarize the impact of tariffs on inflation, outline the inflation risks that the Fed should not ignore and what we see for equities as a result of the Fed’s likely rate cut.

Are tariffs showing up in inflation?

According to last week’s producer price data, intermediate costs (the costs of producing goods) are rising faster than final demand prices (the prices paid by the actual buyer). That difference was the widest in four months in August telling us businesses are absorbing some of the cost increases and margins are narrowing. This was most evident in the services and trade sectors of the economy.

Fed can not ignore underlying inflation risks:

The annual rise in core consumer prices (ex food and energy) has slowed from 5.7% (Feb ’22) to 2.9% in August. However, if you look at an even more core level of inflation (ex food, energy and shelter), prices are rising at the fastest annual pace since June 2023 (2.7% YoY). In addition, consumer prices for services are rising 3.6% annually and have been growing at a 3.6% annual rate for the past five consecutive months. This is above the average seen in the 25 years prior to the pandemic (2.9% YoY). Lastly, consumer food prices rose the most since 2022 in August (+0.6% MoM).

Equities can be disappointed:

The S&P 500 has made more than 50 record high this year and the forward PE multiple has increased 6% in 3Q and is trading at a ~40% premium to its average since 1990. It is fair to say a 25 bps rate cut is fully priced in at these levels. As a result, we see more downside risk in the near term as there is limited catalyst for another leg higher.

The Bottom Line

We agree that the recent labor market and inflation data warrant a rate cut this week. However, beyond the headline data, inflation is still problematic. Our expectation is the Fed will deliver a 25-bps rate cut this week (not 50). Our hope is that they deliver a balanced statement where they acknowledge the weakness in the labor market but emphasize that we are not out of the woods with inflation. No matter what comes out of the meeting, the rally in equities is pricing in rate cuts at each meeting through year end (at a minimum). This leaves little upside at these levels. In fact, any deviation from the markets expectation for consecutive rate cuts could push equities lower.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Consumers continue spending, driven by credit card usage.

- The U.S. added far fewer jobs than originally believed.

- Consumer inflation increased by the most since January.

- Investors rotate into mega-cap tech trade.

- Bond yields fall as demand for Treasuries remains strong.

- Weather concerns drive softs and grains higher.

Weekly Economic Recap — Inflationary Pressures Remain Stubborn

Consumer borrowing increased in July by the most in three months as revolving debt (i.e., credit cards) posted its largest gain in balances for the year. Revolving debt increased a total $10.5 billion for the month driven by sales at online retailers specifically. The share of U.S. consumer debt in “serious delinquency” increased in 2Q25 to the highest level since early 2020 driven by the restarting of payments for student loans.

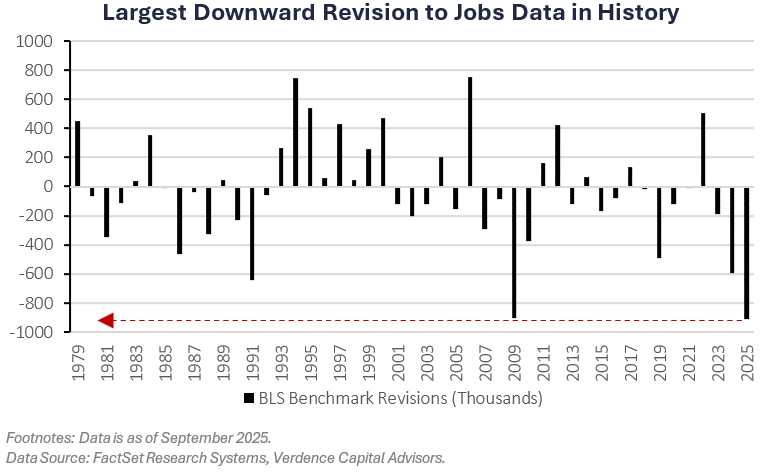

The U.S. economy added far fewer jobs than originally reported over the last year through March 2025. The Bureau of Labor Statistics published their prelimary annual revisions to nonfarm payrolls data which estimates 911K fewer jobs were created. This was the largest downward revision on record.

Producer prices unexpectedly fell for the first time in four months in August (-0.1%). However, excluding food and energy, prices increased 0.3% for the month. Services prices registered a 0.2% drop in August driven by a 1.7% slide in trade services.

Inflation as tracked by the Consumer Price Index rose in August by the most since January, while the annualized rate climbed 2.9%. Higher shelter costs accounted for the majority of the headline advance. Consumer prices excluding food, energy and shelter rose 2.7% YoY, the most since June 2023.

Accordning to the University of Michigan, consumer sentiment fell in September to the lowest level since May. Concerns about the labor market and inflation weighed on the index. Long-run inflation expectations (5-10YR) rose for the second straight month and are well above the 20 year average seen in the years leading up to the pandemic (3.9% vs. average of 2.8% prior to pandemic).

Weekly Market Recap — Large-Cap Growth Rallies as Data Solidifies Fed Rate Cuts

Equities:

The MSCI AC World Index was higher for the second consecutive week as economic data solidified expectations for the Federal Reserve to cut rates at their meeting this week. All major U.S. equity averages were higher led by large cap growth. Growth and tech outperformed after Oracle announced increased guidance and new AI deals. Small-caps, as tracked by the Russell 2000, were higher for the sixth straight week, the longest streak since mid-April.

Fixed Income:

The Bloomberg Aggregate Index was higher for the fourth consecutive week led by municipal bonds. Municipals posted their best week since April as supply slowed and broad fixed income yields fell (prices up). Treasuries rallied on anticipation of rate cuts and strong demand at auctions.

Commodities/FX:

The Bloomberg Commodity Index was higher for the third time in four weeks. Soft commodities and grains were higher, both driven by weather concerns particularly. Gold prices climbed to a fresh record high on weak jobs data in the U.S. and geopolitical concerns as Trump continues to lobby for more sanctions on Russia.

WATCH NOW: Alternate View Podcast

Data is as of September 2025.

Source: FactSet Research Systems, Verdence Capital Advisors