Weekly Investment Insights

An Overview of 1Q25 Earnings Season

Key Takeaways:

- 1Q25 earnings season is underway.

- Financials results start strong, but company executives undertake cautious tone.

- Technology will be in focus; Nvidia pulling projections lower.

- Health care sector projected to report largest earnings growth rate.

- Earnings calls to be in focus, specifically from tariff and economic landscape.

An Overview of 1Q25 Earnings Season

It has been roughly two weeks since the start of 1Q25 earnings season. This earnings season is one we are watching closely for clues on how companies are preparing for and/or currently dealing with international trade disruptions amid an increasingly contentious geopolitical enviornment. The S&P 500 is expected to report year-over-year earnings growth of ~7.2% which would mark the seventh-straight quarter of year-over-year earnings growth.1 On a quarter-over-quarter basis, the Index is expected to report negative earnings growth for the first time since 4Q23. This week, we dive deeper into 1Q25 earnings season.

Financials kick off earnings season:

Major financial firms kicked off 1Q25 earnings season posting mostly better than expected results across the board. As a result, the blended earnings growth rate for the sector has increased to 6.1% (from 2.6% on March 31st), and the sector has been the largest positive contributor to the blended earnings growth rate for the S&P 500 since March 31st. CEOs of major financial institutions still sounded somewhat gloomy on the outlook for the economy. JPMorgan’s Jamie Dimon stated, “the economy is facing considerable turbulence,” and Wells Fargo’s Charlie Scharf said, “[we] expect continued volatility and are prepared for slower economic growth environment in 2025.”

Technology remains in the spotlight:

The information technology sector is expected to report the second-highest year-over-year earnings growth of all eleven sectors (14.0%). The semiconductor industry is expected to be the largest contributor to earnings growth (32%). If the semiconductor industry was excluded from the technology sector, the projected earnings growth rate would fall to 6.4%. Nvidia confirmed they would be reporting ~$5.5 billion in write-downs during the quarter, tied to inventory and commitments for their H20 chip after the Trump administration informed them, they would no longer be able to sell the chips in China.2 This has already negatively impacted the sector’s projected year-over-year earnings growth rate, which is lower than last week’s 14.9% estimate.

Health care to lead earnings growth:

The health care sector is expected to report the largest year-over-year earnings growth of all eleven sectors (34.5%). The projected increase is being led by Bristol Myers Squibb and Gilead Sciences as both companies are benefiting from easy comparisons to a year ago due to R&D costs incurred during the period. If these companies were excluded, the earnings growth rate for the sector would fall to 3.6%.

The Bottom Line:

Over the last 10 years, actual earnings reported by companies have exceeded expectations by ~6.9%. According to FactSet, the blended earnings growth rate could climb to as high as 12.8% for 1Q25 if companies beat expectations at this pace. We still expect companies to beat analyst expectations, but expect the size of the beats to be more modest. We are most interested in comments about tariffs and the economy from company executives.

Your Economic and Market Detailed Recaps

- Consumer spending increases ahead of tariffs.

- ECB cuts interest rates by 25bps.

- Homebuilder confidence remains historically low.

- S. equities lag European counterparts; technology lower.

- Treasury yields lower on hawkish Fed comments.

- Commodities higher for second straight week.

Weekly Economic Recap — Consumers Spend Ahead of Tariff Impacts

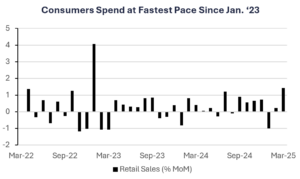

Retail sales increased at the fastest monthly pace since January 2023 (+1.4%) driven by an increase in sales at auto retailers. The report suggested buyers are likely getting ahead of tariffs by increasing purchases of autos, building materials, sporting goods, and electronics, many of which are made in China. The control group, which feeds directly into the calculation for GDP, increased slighly less than expected (+0.4% vs. +0.6% est.).

LISTEN IN: Alternate View Podcast

The European Central Bank (ECB) cut interest rates by 25bps to 2.25% last week. In its policy statement, the ECB said, “the outlook for growth has deteriorated owing to rising trade tensions… increased uncertainty is likely to reduce confidence.”

Homebuilder confidence increased slightly in April but remained constrained near the lowest levels since November 2023. Prospective buyers’ traffic increased slightly, but sales expectations fell to a one-year low and prices of materials are still climbing amid tariffs.

Construction of new homes in the U.S. fell by the most in a year (-11.4%) to an annualized rate of 1.32 million in March. Elevated home prices and mortgage rates led to decreased demand. New single-family home construction fell by the most since the beginning of the Covid pandemic.

Initial claims for unemployment benefits fell to the lowest level in two months (215K), slighly less than expected (225K). Continuing claims, which run a week behind the headline number, increased to 1.89 million.

Weekly Market Recap — European Equities Rally on Tariff Reprieve Optimism

Equities: The MSCI AC World Index was higher for the second straight week. European equities led global performance as news of trade negotiations increased. In the U.S., small-cap equities as tracked by the Russell 2000 were higher for the second straight week. U.S. large-caps were lower driven by technology underperformance after the U.S. announced more restrictions on the export of chips to China.

Fixed Income: The Bloomberg Aggregate Index was higher for the second time in the last three weeks. Hawkish comments from Fed Chairman Powell sparked some risk-off sentiment that helped bond prices move higher, and yields tick lower. All sectors of fixed income posted gains. Municipal bonds were higher for the second time in three weeks.

Commodities/FX: The Bloomberg Commodity Index was higher for the second straight week. Crude oil prices gained the most since the start of the year as the U.S. announced new sanctions on Iranian oil, raising supply concerns. Copper prices were higher by the most since Februrary as buyers look to get ahead of U.S. tariffs.

Data is as of March 2025.

Source: FactSet Research Systems, Verdence Capital Advisors