Weekly Investment Insights

Reviewing 2Q25 Market Volatility – Geopolitics and Trade Uncertainty

Key Takeaways:

- Trade uncertainty and geopolitical tensions sparked 2Q25 market volatility.

- Inflation proving sticky for the Fed.

- Global equities higher by the most since 4Q20 amid resurgence of U.S. large-cap growth trade.

- Bond yields mixed, but all sectors of fixed income rally, except for municipals.

- Crude oil prices drive commodities lower as geopolitical tensions eased.

Reviewing 2Q25 Market Volatility – Geopolitics and Trade Uncertainty

Trade uncertainty and geopolitical tensions in the Middle East sparked volatility through global markets in 2Q25. Global equities plummeted to start the quarter after President Trump announced his aggressive “Liberation Day” tariffs. However, equities recouped most of their losses to finish the quarter in positive territory. In fact, the S&P 500 and the Nasdaq closed the quarter at a record high. Fixed income sectors were mostly higher on lower yields. In addition, investors flocked to precious metals amid the geopolitical turmoil. In this Weekly Insights, we review 2Q25 from an economic and asset class perspective.

- Inflation proving sticky: The Fed’s preferred inflation gauge, PCE Core, showed prices increasing at a faster-than-anticipated pace (2.7%) and above their 2% target.

- Labor market stilll expanding: The three month moving average of payroll additions rose to the highest since January 2025. In adddition, job openings rose to the highest level since November 2024 and the unemployment rate fell to a four month low.

- Housing market weak: Homebuilder confidence fell to the lowest level since December 2022 and sales of new homes are at the lowest level since October 2024.

- Manufacturing under pressure: The ISM Manufacturing Index was in contraction territory (a reading below 50) for four straight months. Imports fell amid Trump’s tarrifs, and prices paid for inputs remain elevated.

Global Equities – Resurgence of the growth trade:

The MSCI AC World Index was higher by the most since 4Q20. The S&P 500 and Nasdaq notched three consecutive record-high closing days to end the quarter.

- S. large cap growth leads: The Russell 1000 Growth Index outperformed its value counterpart by the most since 4Q99 (~1400bps).

- International leading rally: The MSCI EAFE Index outperformed the S&P 500 for the second consecutive quarter. Year to date it is leading its U.S. counterpart by ~1300 bps.

Fixed Income – Bond yields mixed:

The Bloomberg Aggregate Index was higher for the second straight quarter as volatility in risky assets surged.

- Fiscal policy concerns sent long term yields higher: Short duration bonds outperformed long duration bonds as investors feared Trump’s tax bill would add to the burgeoning fiscal deficit.

- Municipals lag: Municipal bonds were lower as the market remains oversupplied. Issuers aimed to get ahead of a potential repeal of tax-exemption status, which did not come to fruition in Trump’s tax bill.

Commodities mixed:

The Bloomberg Commodity Index fell by the most since 4Q23 as the drop in energy overshadowed the rally in gold.

- Gold prices rally: Geopolitical uncertainty and concern over the burgeoning deficit sent gold prices higher for the sixth time in the last seven quarters.

- Oil prices lower: Crude oil prices fell for the second straight quarter as geopolitical tensions eased in late June.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Manufacturing contracts for fourth straight month.

- Job openings unexpectedly rise.

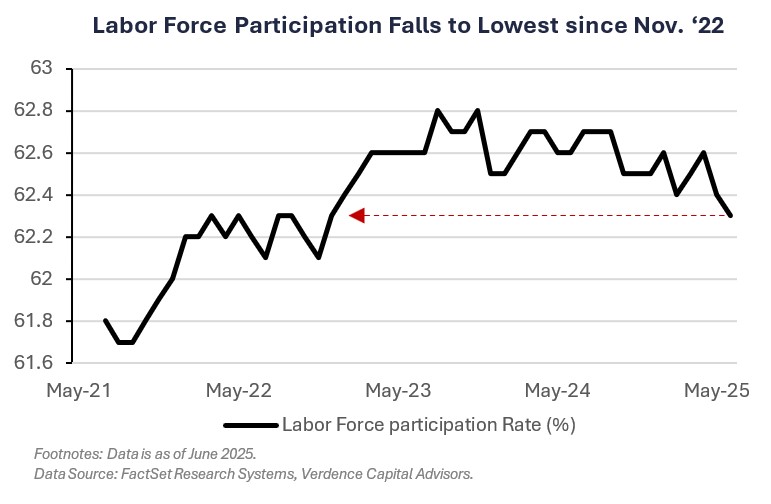

- U.S. labor force participation rate declines.

- Global equities rally on positive trade negotiations.

- Riskier areas of fixed income outperform.

- Commodities higher driven by trade deal optimism.

Weekly Economic Recap — Underlying Cracks in Labor Market

Manufacturing activity in the U.S. contracted for a fourth straight month in June according to the ISM Manufacturing Index. The New Orders Index contracted for a fifth straight month and prices paid remained in expansion territory (a reading above 50), suggesting higher prices for inputs.

Activity in the services sector expanded moderately in June according to the ISM Services Index. New orders led the growth. The employment gauge, however, contracted for the third time in the last four months as service providers adjust headcounts.

Job openings unexpectedly increased in May to the highest level since November (7.77 million) and layoffs declined. Vacancies in the hospitality sector accounted for over half of the overall job openings for the month. The quits rate (i.e., those leaving their jobs voluntarily) edged slightly higher to 2.1% (from 2%). Hiring declined broadly, with hiring in the manufacturing industry declining to the lowest level since 2016.

The U.S. economy added more jobs than expected in June (147K vs. 106K est.). The unemployment rate fell to the lowest since February (4.1%), but the labor force participation rate (i.e., those working or actively looking for work) fell to its lowest level since November 2022. The household survey showed those who have not looked for a job in the past four weeks increased 234K to 1.8 million.

Weekly Market Recap — Global Equities Rally Supported by Trade Optimism

Equities:

The MSCI AC World Index was higher for the second consecutive week as investors digested the latest developments from trade negotiations and progress on Trump’s spending bill. Major averages in the U.S. were higher and led global performance. Small and Midcap equities outperformed and the Russell 2000 was higher for the third straight week. The tech-heavy Nasdaq and S&P 500 each closed at record highs for the second straight week.

Fixed Income:

The Bloomberg Aggregate Index was higher for the second consecutive week. U.S. Treasuries were little changed until Thursday after the release of a hotter-than-expected June payrolls report. Riskier areas of fixed income, including high yield corporate bonds and EM debt (USD), outperformed amid favorable macroeconomic conditions.

Commodities/FX:

The Bloomberg Commodity Index was higher for the third time in the last four weeks. Crude oil prices were higher for the third time in the last four weeks on trade optimism which may suggest an increase in demand. Grains were also higher on the trade deal between the U.S. and Vietnam.

WATCH NOW: Alternate View Podcast

Data is as of June 2025.

Source: FactSet Research Systems, Verdence Capital Advisors