Weekly Investment Insights

Scoring our 2025 Investment Themes

Key Takeaways:

- How well did our 2025 themes do?

- U.S. economy expands at a slower rate than consensus estimates.

- Inflation moving in waves.

- Global equity returns defy expectations despite a high bar.

- Fed cut rates more than expected in 2025.

Scoring our 2025 Investment Themes

This will be our last Weekly Insights for the year but we look forward to producing many more insights next year to navigate through the financial markets and the ever evolving economy. This year brought its challenges from an economic and market perspective but investors were handed solid returns by the end of the year. In our final Investment Insights of 2025, we took the time to score our themes for 2025, which we released at the beginning of the year.

Expansion to continue but at a slower rate (CORRECT):

As 2025 began, we were cautiously optimistic on U.S. economic growth and anticipated 1H25 to be the most vulnerable given a new President, softening personal finances, and stubborn inflationary pressures. Our out-of-consensus view for slower GDP growth came to fruition as U.S. GDP contracted in 1Q25 for the first time since 1Q22. In addition. U.S. GDP is expected to grow 1.7% – 2.0% in 2025, lower than 2024 (2.8%), and below the median average 2.9% growth in the post-COVID era.

Inflation battle is not over (CORRECT):

We argued that inflation moves in waves as opposed to retreating steadily to the Fed’s target. CPI core inflation increased at the slowest pace this year (and since 2021) at 2.6% YoY in November, but we are cautious on this reading. The Bureau of Labor Statistics did not release monthly readings for various categories given the government shutdown. In addition, PCE Core troughed in April (2.6% YoY), but has trended higher (currently at 2.8% YoY).

Global Equities – Expect more muted returns with bar set high (INCORRECT):

We anticipated the challenging macroeconomic backdrop would weigh on equity performance. Instead, the MSCI AC World Index and S&P 500 are both on track to post their third straight year of double-digit gains.The AI trade remained more resilient than we anticipated. We did see rotations into U.S. small-caps and developed markets (MSCI EAFE) as opportunities emerged.

Fixed Income – Higher for longer (INCORRECT):

The Federal Reserve cut interest rates more than we expected in 2025. As interest rates were cut more than anticipated, the 10YR U.S. Treasury yield has fallen ~40bps YTD and has outperfomed 2YR and 5YR U.S. Treasuries.

Alternatives – A shelter from expensive public market (CORRECT):

We expected heightened volatility in 2025 amid stretched public market valuations. We recommended qualified investors allocate to alternative investments. Volatility, as tracked by the VIX Index1 reached its highest level since the height of the Covid pandemic in 2025. Hedge fund performance has been resilient despite volatility, as the Pivotal Path Composite Index2 is higher by ~11% this year.

The Bottom Line:

While we did not score a perfect 100%, we had ample dry powder to take advantage of opportunities that arose through the year (e.g. “Liberation Day”). We look forward to offering guidance in 2026. Again, we would like to wish everyone a happy and healthy holiday season, and a safe start to the new year!

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Homebuilder confidence marginally improves.

- Unemployment rate climbs to highest since Sept. 2021.

- Core CPI increases at slowest pace since March 2021.

- Global equities finish mixed; AI trade sees late-week rally.

- Bond yields fall as investors weigh Fed’s rate path.

- Commodities lower as energy prices fall.

Weekly Economic Recap — Inflationary Pressures Ease, but Full Picture is Not Clear

Confidence among U.S. homebuilders increased moderately in December. Mortgage rates have been hovering near one-year lows, and 67% of builders reported using sales incentives to entice buyers, both of which helped pull potential buyers off the sidelines.

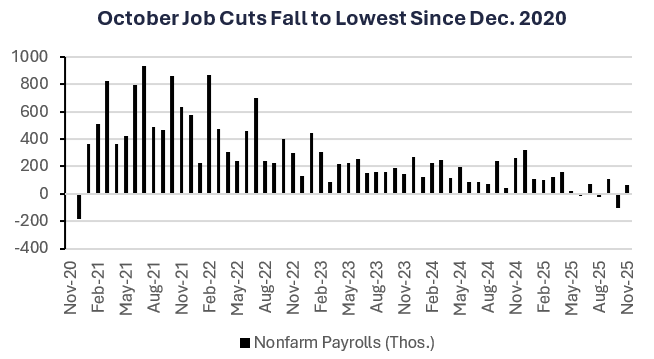

The U.S. economy added more jobs than expected in November (64k vs. 40k est.) but the unemployment rate increased to its highest level since September 2021 (4.6%). The health care sector accounted for more than 70% of total job gains. The labor force increased by ~320k, pushing the labor force participation rate to 62.5%. In addition to the November release, abbreviated data for October showed payrolls contracted by 105k, the largest since December 2020.

The value of U.S. retail sales were relatively unchanged in September. Eight of thirteen categories posted increases, led by department stores and online merchants, signaling strong holiday spending. Motor vehicle contracted as the expiration of EV tax incentives expired. The control group (which excludes food services, auto dealers, building materials, and gasoline stations), which filters into the government’s calculation of GDP, increased by the most in four months (0.8%).

Headline inflation increased at a slower-than-expected pace in November (2.7% YoY vs. 3.0% YoY est.). Core CPI, which strips out volatile food and energy prices, fell to the lowest level since March 2021 (2.6%). However, this report excluded numerous data points included in the typical CPI release because of the government shutdown.

Weekly Market Recap — Global Equities Flat as Global Central Bank Policy Diverges

Equities:

The MSCI AC World Index was marginally lower for the second straight week as central bank policy diverged and economic data was mixed. The ECB kept rates unchanged, the BoE cut rates by 25bps, and the BoJ raised rates to a 30YR high. In the U.S., the small-cap Russell 2000 was the weakest performing average, lower for the first time in three weeks. AI/tech was lower to start the week, but reversed course to finish higher, causing the Nasdaq to post the strongest performance in the U.S.

Fixed Income:

The Bloomberg Aggregate Index was marginally higher for the second straight week. Bond yields were lower as investors continued to assess the Fed’s interest rate cut from the prior week. All sectors of fixed income generated positive returns for the week as yields fell (bond prices and yields have an inverse relationship).

Commodities/FX:

The Bloomberg Commodity Index was lower for the second straight week amid falling energy prices. Crude oil prices were lower for the second straight week as investors see potential surplus to markets as peace negotiations between Russia and Ukraine continue. Soft commodities were also lower driven by coffee prices, which fell for the third straight week.

WATCH NOW: Alternate View Podcast

Data is as of November 2025.

Source: FactSet Research Systems, Verdence Capital Advisors