Weekly Investment Insights

Stock Market Seasonality: Why August, September Are Historically Weak

Key Takeaways:

- Stock Market Seasonality: August and September are historically the weakest months for the S&P 500.

- Labor market may not be as resilient as believed.

- Uncertainty in trade negotiations will likely persist, despite “reciprocal tariffs” taking effect.

- Valuations still stretched thin.

- Macro uncertainty signals a pullback for U.S. equities may take shape.

Are Markets Feeling the End of Summer Blues?

With U.S. equity markets sitting at or near all time highs, we thought it would be valuable to revisit our stock market seasonality analysis. Since 1945, August and September have historically been the weakest performing back-to-back months for the S&P 500, with the average return for both months in negative territory. These are the only two months that share this back-to-back trend. (The only other month with an average negative return is February). There are several theories/opinions on why this period is historically weak. Some including money mangers coming back from vacations, portfolio rebalancing, and tax-loss selling, particularly from large asset managers. However, it’s important for investors to remember that these are just theories. They should not be understood as fact. In this Weekly Insights, we address risks we see that may contribute to a seasonally weak period.

Using history as a guide:

We analyzed monthly returns (price change only) for the S&P 500 going back to 1945. We found the average return for the month of August was -0.01% and it was higher ~55% of the time. The average return for the month of September was -0.75% and it was higher only ~45% of the time. In the year following a presidential election, the monthly performance is even more negative. August’s average return falls to -0.7%, while September’s is -0.4%.

Labor market and the Fed:

The July employment report showed investors that hiring slowed and the unemployment rate rose. Over August and the first half of September there will be several reports for the Fed and markets to absorb before the Fed meets again in September (17-18th). This can fuel volatility leading up to the meeting as investors are pricing in a strong likelihood the Fed starts cutting rates again. We will receive another employment report, several jobless claims reports and the JOLTS report before then.

Tariff still a market mover.

President Trump’s “reciprocal tariffs” officially went into effect on August 7th. While negotiations between the U.S. and trading partners continue, it is unclear how (if at all) tariffs will impact inflation and economic growth throughout the rest of the year.

Valuations stretched:

The S&P 500 NTM P/E ratio is ~at the highest level aside from the height of the Covid pandemic and dot-com bubble. We believe valuations may be due for a correction as investors factor in the slow economic growth trajectory, stubborn inflation and challenges for earnings and margins.

The Bottom Line:

History can be used as a guide when monitoring short-term market patterns, but fundamentals and valuations are more important for the long run. After an impressive summer rally (S&P 500 is up over 10% since Memorial Day), it is important to not get complacent as we enter a stock market seasonality weak period for equities. With a 90% chance of a rate cut at the Fed’s September meeting, there is the chance that markets get disappointed (with Fed action or tone). The economy is slowing but inflation risks remain to the upside, making the Fed’s job difficult. Unfortunately, valuations in equities are fully reflecting the rate cut and may be too optimistic about the Fed’s flexibility this year.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

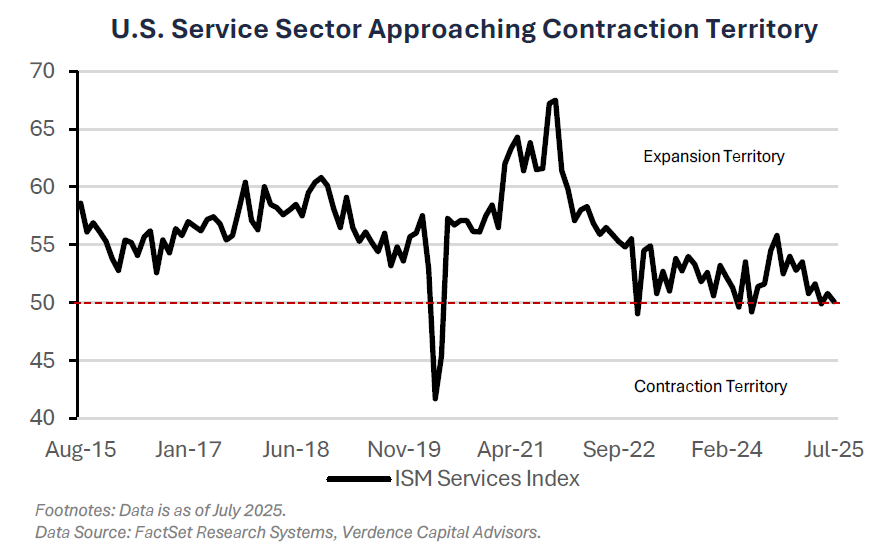

- U.S. services sector stagnates.

- U.S. trade deficit declines to tightest since Sept. 2023.

- Jobless claims continue to tick higher.

- Global equities rally on strong corporate earnings.

- Bond yields rise due to weak Treasury demand.

- Commodities higher driven by higher coffee prices.

Weekly Economic Recap — U.S. Services Sector Stagnates on Employment Weakness

The U.S. services sector stagnated in July as firms continued to reduce headcount. The ISM Services Index remained marginally in expansion territory (50.1) but was weaker than estimates (51.3). The employment index fell for the fourth time in five months, while the prices paid component increased to the highest since October 2022.

The U.S. trade deficit declined 16% to $60.2 billion in June, the tightest since September 2023, as companies continued to slow their pace of imports after an early-year surge. Imports of consumer goods fell to the lowest level since September 2020.

Initial jobless claims increased slightly more than expected last week (226K vs. 222K est.). Continuing jobless claims, which run a week behind the headline number, increased to 1.97 million, the highest since November 2021.

Consumer credit increased in-line with the consensus estimate (~$7.4 billion) in June, but it was higher than in May ($5.1 billion). Revolving credit, which includes credit cards, was virtually unchanged, while nonrevolving credit (i.e., auto loans, student loans) led the broad increase.

The Bank of England (BoE) cut rates to 4% at their latest meeting in what was described as a “gradual and careful” approach to monetary easing. The nine-member voting committee was split on the decision, needing two rounds of voting to ultimately move forward with the 25bps cut. The central bank needed to weigh sticky inflationary pressures and a cooling labor market which contributed to the divergence among members.

Weekly Market Recap — Global Equities Supported by Strong Corporate Earnings

Equities:

The MSCI AC World Index was higher for the third time in four weeks as investors received stronger-than-expected U.S. corporate earnings. President Trump’s “reciprocal tariffs” took effect on Thursday, but did little to rattle markets. Growth sectors within the U.S. led performance and drove the Nasdaq Composite Index to end the week at a fresh record high.

Fixed Income:

The Bloomberg Aggregate Index was slightly lower last week as Treasury yields rose on weak demand at auction. Investment grade corporate bonds also declined as yields rose. Municipal bonds finished the week higher as demand increased.

Commodities/FX:

The Bloomberg Commodity Index was higher for the first time in three weeks. Gold prices rose for the second straight week on uncertainty surrounding the tariff implications of the precious metal. Soft commodities were higher driven by higher coffee prices on tighter supplies out of Brazil.

WATCH NOW: Alternate View Podcast

Data is as of July 2025.

Source: FactSet Research Systems, Verdence Capital Advisors