Weekly Investment Insights

Taking a Closer Look at Digital Assets – Stablecoins

Key Takeaways:

- U.S. Senate passes first-ever legislation for U.S. Dollar pegged stablecoins.

- Stablecoins are not cryptocurrencies because they are backed by cash or cash equivalent assets.

- Stablecoins may prove more efficient than normal cross-border payment systems.

- Consumers and private companies may adopt stablecoins to cut down on credit card fees.

- Beware of this highly volatile product at this time.

Taking a Closer Look at Digital Assets – Stablecoins

Stablecoins were introduced in 2014 and have been making headlines recently after the U.S. Senate passed the GENIUS Act on June 17th, 2025. The bill, which establishes the first-ever federal regulations for U.S. Dollar pegged stablecoins, was passed in a rare case of bipartisanship with a 68-30 vote. The bill establishes centralized oversight with the U.S. Treasury and requires issuers to maintain at least a one-to-one reserve backing of safe assets (e.g., US T-Bills or U.S. Dollars). Given the developing headlines we are using this Weekly Insights to provide an overview of the stablecoin market, examine potential consumer benefits, and caution investors about this newly regulated product.

- What are stablecoins? Stablecoins are a type of digital asset designed to maintain a store of value to a pegged asset, such as the U.S. Dollar. They are not considered cryptocurrencies because issuers of stablecoins hold cash or other cash equivalents that back the digital asset. Stablecoin values do not fluctuate with supply and demand like cryptocurrencies. The total transfer value of stablecoins in 2024 exceeded $27 trillion, greater than Mastercard and Visa transaction volume combined.1

- Efficiency in cross-border payments: Stablecoins may help facilitate cross-border payments and reduce complexities involved in currency conversion through traditional foreign exchange channels. Currently, international wire transfers can take anywhere between 1-5 business days, and the timing can be impacted by factors, such as time zone differences and currency conversions. International stablecoin transactions can take place in a matter of minutes, making cross-border transactions more time efficient.

- Cards vs. Coins: Another evolving case in support of stablecoins is in the retail space. When consumers use credit cards to purchase retail goods, the merchants accepting payment have to pay a processing fee, generally ranging from 1.1%-3.15% per transaction.2 In fact, credit card companies earned ~$148 billion from charging these fees in 2024, and the fees (which are passed through to consumers) cost families ~$1,200.2 Stablecoin transaction costs vary depending on the blockchain network, network congestion, and overall transaction speed. While holding stablecoins may have small fees, converting or selling stablecoins can incur additional fees.

The Bottom Line:

Stablecoins are a newly regulated product introducing more questions than answers. While they may be linked to safe investments, the liquidity can be unpredictable. Stablecoins can “break the buck” like a money market mutual fund in times of stress (e.g., Terra in May 2022). Currently, not all stablecoins are backed by Treasuries and investors can be subject to complete loss of capital invested. While stocks linked to the stablecoin market surged after GENIUS Act passed, we would be cautious chasing these securities. The regulation and products are in the infancy stages with a variety of fees, and yields that can be lower than cash. Therefore, we do not recommend these products currently but we will watch the evolution of this market closely.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Consumer confidence deteriorates further.

- 1Q25 GDP contracts at steeper pace than estimated.

- Fed’s preferred inflation gauge rises more than expected.

- Global equities rally on cooling Middle East tensions.

- Bond yields lower on Fed commentary.

- Commodities lower after geopolitical tensions ease.

Weekly Economic Recap — Consumer Confidence Slides and Inflation Proving to be Stubborn

U.S. business activity, according to the S&P U.S. PMI Index, expanded in June for the 29th consecutive month. New orders have increased for 14 straight months and contributed the most to growth. Exports of goods and services decreased and weighed on growth as tariffs were widely to blame, according to the survey.

Consumer confidence, as measured by the Conference Board, declined in June. Sentiment on present and future expectations for the economy fell. In addition, the share of consumers that said jobs were plentiful fell to the lowest level in more than four years.

U.S. GDP for 1Q25 contracted at a faster-than-expected pace (-0.5% Q/Q vs. -0.2% Q/Q in prior reading). Consumer spending was revised down to the weakest pace since 2Q20. Initial estimates showed spending on services increased ~0.8% in the first quarter, while the most recent reading showed spending only increased 0.3% Q/Q.

New home sales plummeted in May to an annualized pace of 623K as investors contended with elevated mortgage rates in May. Slower sales led to a surge in supply, climbing to 9.8 months. This represents the highest level of supply since the Fed first started raising rates in the summer of 2022.

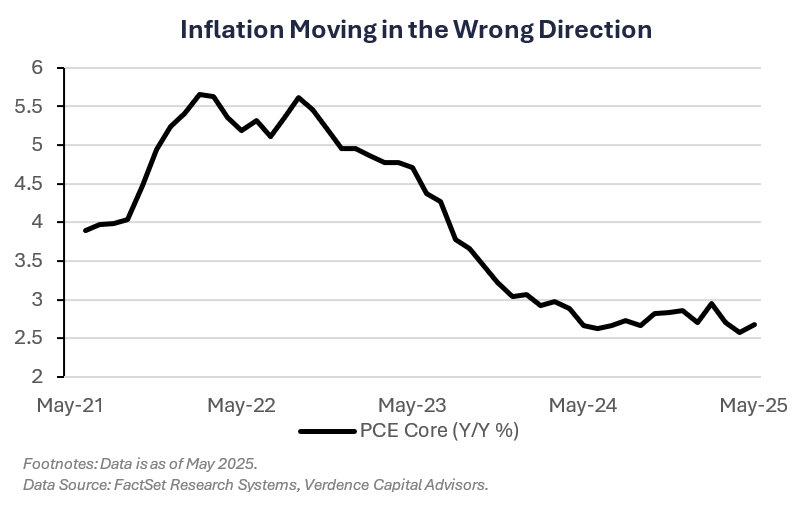

The Fed’s preferred inflation gauge, PCE Core, increased at a faster-than-expected pace in May (2.7% Y/Y vs. 2.6% Y/Y est.). The headline reading increased in line with estimates (2.3% Y/Y) driven by food and shelter prices specifically.

Weekly Market Recap — Global Equities Higher as Geopolitical Tensions Ease

Equities:

The MSCI AC World Index was higher for the first time in three weeks and by the most in in two months as a ceasefire deal between Israel and Iran and positive rhetoric out of U.S. trade negotiations supported risk appetite. The U.S. led in the global equity rally with all major averages higher. The S&P 500 and Nasdaq Index finished at record highs. Equities in Europe were higher bolstered by easing tensions in the Middle East and NATO promising to increase defense spending to 5% of GDP.

Fixed Income:

The Bloomberg Aggregate Index was higher last week as Fed officials suggested rate cuts could be coming in the near future. U.S. Treasury yields were lower across the curve as a result (bond prices and yields move in inverse directions). All sectors of fixed income were higher.

Commodities/FX:

The Bloomberg Aggregate Index was higher last week as Fed officials suggested rate cuts could be coming in the near future. U.S. Treasury yields were lower across the curve as a result (bond prices and yields move in inverse directions). All sectors of fixed income were higher.

WATCH NOW: Alternate View Podcast

Data is as of May 2025.

Source: FactSet Research Systems, Verdence Capital Advisors