Weekly Investment Insights

Tariff Day is Upon Us… Again!

Key Takeaways:

- Tariff extension deadline upon us.

- U.S. bringing in solid revenue.

- American companies have reached some good deals.

- NAFTA countries unlikely to see agreement before August 1.

- Watching July 31st higher court ruling on Trump’s tariffs.

Tariff Day is Upon Us… Again!

This Friday is the trade deal deadline outlined by the Trump Administration. While progress was initially slow, we are seeing a flurry of activity over the past week. In addition, with the S&P 500 closing at its 13th record high this year, there does not seem to be concern from investors about tariffs. Instead they are focusing on the Fed and earnings season. Given the timeliness of the tariff topic, we use this weekly to offer an update on trade deals.

- Look at the numbers. Total U.S. trade (exports and imports) was ~$7 trillion at the end of 2024. Imports alone ($4.1 trillion) make up ~14% of GDP. One of Trump’s goals is to increase revenue. As of July 25, the U.S. has collected over $120 billion in tariff revenue year to date. This is up from ~$50 billion at the same time in 2024.

- What we know: Some deals announced were agreed upon as a framework. The main countries worth noting that have deals include Japan, UK, EU, Indonesia, Philippines and Vietnam. The U.S. agreed to a 15% baseline tariff with Japan and the EU that seems to be a framework for other key trading partners.

- NAFTA countries: Trade talks with Canada and Mexico have stalled. Both countries currently benefit from the tariff suspension on USMCA compliant goods.1 If no deals are made, Canada imports could be tariffed at 35% and Mexico at 30% (up from 25%).

- European Union and Japan: The U.S. and the EU and Japan have agreed upon a 15% baseline tariff. This is lower than the original threatened tariffs (between 20-30%). While certain sectors are still being negotiated (e.g., wine, steel, aluminum), this is a positive step in leveling the playing field with trade. In addition, Japan and the EU have commited to long term investment in the U.S.

- China: The U.S. and China have a temporary agreement through August 12th. There is a meeting set early this week and if nothing is agreed upon by the new deadline, the trade war can escalate with tariffs increasing sharply. The U.S. has larger goals with China which include access to rare earth materials, intellectual property protection and better oversight into chip exports (among other items).

The Bottom Line:

Businesses continue to make note of tariff related impacts in earnings reports, but the direct impact has been muted thus far. We think they will make progress on trade and the average tariff rate may be settled around 15-20% (up from 2-3% prior to Liberation Day). Equities have phased out the tariff threat and instead are focusing on the strong start to 2Q25 earnings season. We believe the trade deals settled on thus far can benefit American companies in the long run. However, in the near-term tariffs threaten margins, potentially inflation and elevated multiples. The next biggest test for tariffs will be the July 31st ruling from the Federal circuit court that will either allow Trump’s use of IEEPA to institute tariffs or decide it is outside his Presidential authority.2

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

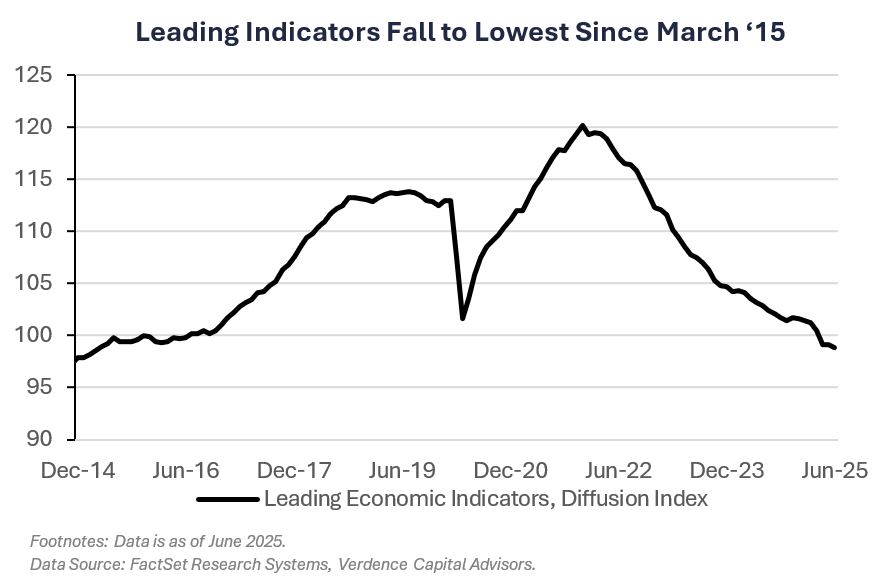

- Leading economic indicators continue to deteriorate.

- Home sales turn lower amid elevated mortgage rates.

- Service activity climbs, offsetting drop in manufacturing.

- Global equities rally as investors cheer trade deals.

- Bond yields fall on U.S. trade announcements.

- Commodities lower driven by weakness in energy prices.

Weekly Economic Recap — Housing Data Showing Improvement in Supply

The Leading Economic Indicators Index declined 0.3% in June. Low consumer expectations, weak new manufacturing orders, and a third consecutive month of rising claims for unemployment offset higher stock prices (the main support for the index).

Sales of previously owned homes fell 2.7% in June to a seasonally adjusted annual rate of 3.93 million. Elevated mortgage rates (between 6.8% – 7.0% during the period) have pushed buyers to the sidelines. Supply grew further in June to 1.53 million units, a 15.9% year-over-year growth.

Sales of new homes remained weak in June as homebulders struggle to offset high prices and elevated mortgage rates with sales incentives. Contract signings increased to an annualized rate of 627K (vs. 659K est.). The supply of new homes increased to the highest level since 2007 (511K), while the median sales price fell 2.9% over the past year to ~$402K.

U.S. business activity expanded at the fastest rate this year in July according to S&P Global, driven by services. The service activity gauge advanced to the highest level this year and more than offset the the slowdown in manufacturing, which fell into contraction for the first time since December. Prices paid continued to tick higher. Prices received also edged higher as companies pass costs on to consumers.

The European Central Bank (ECB) kept rates unchanged (at 2%) for the first time in more than a year at their most recent policy meeting. The decision comes after inflation in the region hit 2% and trade negotiations with the U.S. remain uncertain. “We are in a good place because inflation is at 2%”, said President Christine Lagarde.

Weekly Market Recap — Global Equities Surge as Investors Welcome Trade Deals

Equities:

The MSCI AC World Index was higher for the fourth time in the last five weeks as investors welcomed fresh trade deals. All major U.S. averages were higher. The S&P 500 notched five consecutive days of record closes for the week supported by the trade news and better-than-expected 2Q25 earnings. Equities in Japan were sharply higher after the trade deal announcement with the U.S.

Fixed Income:

The Bloomberg Aggregate Index was higher for the first time in three weeks as bond yields fell after positive trade deal annoucements and positive Fed independence headlines (bond yields and prices have an inverse relationship). Long-term yields fell the most on the news. All sectors of fixed income were higher, with the exception of U.S. TIPS.

Commodities/FX:

The Bloomberg Commodity Index was lower for the first time in four weeks driven by energy price weakness. Natural gas prices fell the most since January as supplies increased. Crude oil prices were also lower as investors remained cautious on the demand outlook.

WATCH NOW: Alternate View Podcast

Data is as of June 2025.

Source: FactSet Research Systems, Verdence Capital Advisors