Weekly Investment Insights

Have Trade Wars Deterred Foreigners from Buying U.S. Assets?

Key Takeaways:

- Trump’s America First agenda has some concerned about investors pulling out of U.S.

- Instead, foreigners and U.S. companies are spending massively on U.S. investments.

- The concern that Treasuries would be used as a bargaining chip have not materialized.

- All major auctions have been relatively strong.

- TIC data shows record demand.

- Trade Wars Deterred Foreigners

Have Trade Wars Deterred Foreigners from Buying U.S. Assets?

Since President Trump took office there has been speculation that his America First and trade policy would impact investments into the U.S. from international companies, governments and investors. Fortunately, we have not seen this materialize, at least as of now. In fact, as of May 6th, there has been over $2 trillion in U.S. based investments from U.S. and foreign companies. This is separate from the over $3 trillion that has been committed for investments from foreign countries (e.g. UAE, Saudi Arabia).1

In addition, we have been monitoring Treasury auctions because ~25% of our Treasury debt outstanding is financed from investors outside of the U.S. There was concern that some of our key trading partners would use Treasury debt as a bargaining chip by either selling Treasuries or pulling away from the auctions. In this weekly insights we offer details about the Treasury auctions we have been monitoring in recent months to see if there is less foreign demand. In addition, we detail what we saw from last week’s monthly Treasury International Capital report.

READ NOW: Economic Impact on Tariffs

Why do Treasury auctions matter?

To fund the burgeoning budget deficit the Treasury relies on investors buying Treasuries at their auctions. According to the Peterson Foundation, ~$9 trillion in U.S. debt is maturing within a year.1 If demand for Treasuries slows at auction, the U.S. government would be at a greater risk of not being able to refinance its debt or be subject to paying a higher interest rate to fulfill auctions.

What recent auctions are telling us:

On May 6th, 2025, the U.S. Treasury auctioned 10-year notes worth ~$42 billion and demand was strong from both domestic and international purchasers. Direct bidders (i.e., institutional investors, state/local governments) claimed ~20% of the auction, while indirect bidders (i.e., foreign entities) claimed ~71% of the auction. Both direct bidders and indirect bidders claimed more than the historical averages of 17% and 67.6%, respectively.2 Foreign demand, specifically, has been strong in most other auctions. The 4-week, 6- month, 5-year and 10-year auctions have seen demand above the past five-year average.

LISTEN NOW: Markets With Megan

Treasury International Capital report (TIC):

We received the TIC data for March last week which details foreign investment in the U.S. This report is offered on a lag and the data is prior to “Liberation Day.” In the report, it showed that foreign investors of U.S. Treasuries reached a record high ~$9 trillion. Japan is the largest foreign holder of U.S. Treasures ($1.1 trillion). The UK surpassed China as the second largest foreign holder as China’s holdings declined.

The Bottom Line:

Since writing this weekly, Moody’s downgraded the rating of U.S. debt due to the fiscal outlook. While we have seen little, if any, impact from tariffs on the demand for U.S. investments, Treasury auctions, specifically will take on more importance in the direction of interest rates. We will monitor closely all auctions with a focus on the bellwethers (e.g., 10YR and 30YR) to see if the rating impact along with trade disputes deters foreign investment. This could have long-term impacts on interest rates, inflation and the Fed.

Your Economic and Market Detailed Recaps

- Government budget deficit tops $1 trillion; 13% higher YoY.

- Headline inflation increases at slowest pace since Feb. ‘21.

- Consumers slow their pace of spending.

- Global equities rally on U.S./China trade developments.

- Treasury yields broadly higher on flurry of economic data.

- Commodities mixed; Natural gas plummets

Weekly Economic Recap — Inflation Showing Signs of Easing

The U.S. service sector as measured by the ISM Services Index rose in April and remained in expansion territory (a reading above 50) for the 10th consecutive month. The prices-paid component increased to a two-year high of 65.1 with nearly 40% of purchasing managers reporting higher prices, the largest share since November 2022.

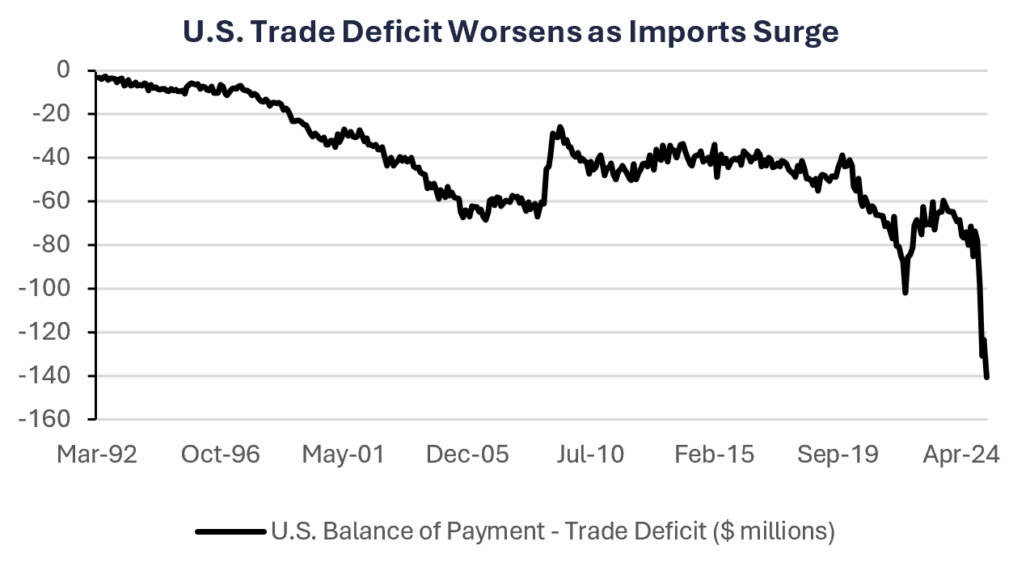

The U.S. trade deficit widened to a record in March ($140.5 billion) as companies rushed to import products ahead of Trump’s tariffs. Consumer goods imports climbed by the most on record, primarily driven by the largest-ever inflow of pharmaceutical products.

The Federal Reserve kept interest rates unchanged at their latest meeting (at 4.25% – 4.5%). The post-meeting statement read, “the risks of higher unemployment and higher inflation have risen.” Fed Chairman Powell reiterated the committee’s stance on remaining heavily reliant on incoming data to drive decisions for interest rates and that “the economy is in a good place… we don’t need to be in a hurry to cut rates.”

LISTEN NOW: Alternate View Podcast

Consumer borrowing increased in March by the most in three months driven by an increase in credit-card balances. Total credit climbed $10.2 billion after falling a revised $614 million in February. Non-revolving debt, including loans for vehicle purchases and school tuition, increased $8.3 billion.

The Bank of England cut interest rates by 25 bps last week to 4.25%. The central bank cited uncertainty around tariffs and underwhelming economic growth. The post-meeting press release stated, “[the] prospects for global growth have weakned as a result of [trade policy] uncertainty.”

Weekly Market Recap — Global Equities Rally on U.S. and China Trade Optimism

Equities:

The MSCI AC World Index was higher for the fifth time in the last six weeks and posted its best weekly gain since November 2023. The rally was driven by the U.S. and China announcing plans to lift trade restrictions for 90 days. All major U.S. averages were higher driven by a tech/growth rally as investors had a risk-on appetite. International markets rallied as well, with China equities getting a boost on the trade developments.

Fixed Income:

The Bloomberg Aggregate Index was lower for the third straight week amid a flurry of economic data and global trade developments. High yield and emerging market bonds led the gains as investors took a risk-on appetite.

Commodities/FX:

The Bloomberg Commodity Index was lower for the third time in four weeks. While oil prices rose on optimism that calming in the trade wars can fuel growth, natural gas prices fell sharply, pulling the energy index lower.

Have Trade Wars Deterred Foreigners from Buying U.S. Assets?

Data is as of April 2025.

Source: FactSet Research Systems, Verdence Capital Advisors