Weekly Investment Insights

Understanding the Treasury Market Selloff

Key Takeaways:

- U.S. Treasuries continue to rise as we come into 2025.

- Investors repricing expectations for number of Fed rate cuts.

- Inflation concerns fuel the selloff in yields.

- A tough road ahead of housing with mortgage rates rising.

- Yield volatility to remain heightened.

Understanding the Treasury Market Selloff

While bond investors were offered some reprieve last week, U.S. Treasury yields have risen in 2025 with the 10 YR U.S. Treasury yield climbing to the highest level since October 2023. And the 30 YR yield crossing above the psychological 5.0% level. The rise has been led by long term rates. This has resulted in a normalization of the yield curve (the difference between short and long term rates). In this weekly, we address the reasons behind the move higher in long term interest rates and what it means for the economy and equity markets.

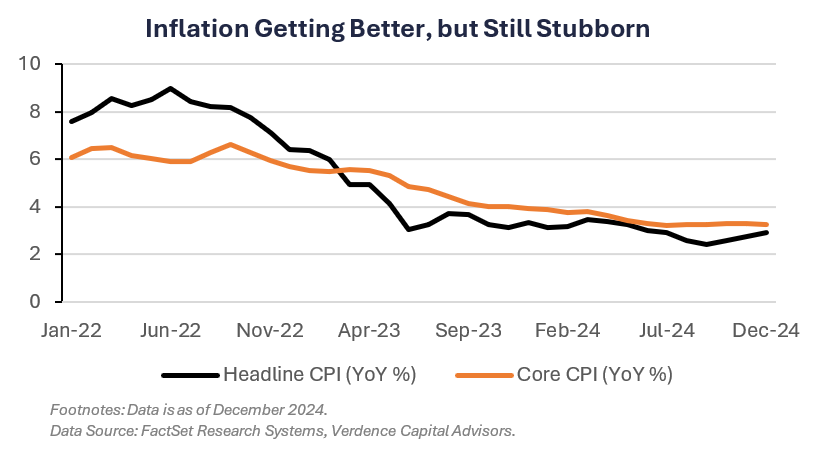

- Repricing Fed rate cuts: With the U.S. economy remaining resilient and inflation proving stubborn, investors have been repricing the timing and magnitude of future rate cuts. Currently, the Fed funds futures market is pricing in one to maybe two rate cuts in 2025. This is less than the four to six that were priced in just four months ago. This has led to what is called a bear steepening of the yield curve, a phenomenon where long-term rates rise faster (due to a rise in long-term inflation expectations) than short-term rates (past and future rate cuts are priced in).

- Inflation expectations are rising: Long term inflation expectations in not only the bond market but also by consumers have been surging. For example, the 10YR breakeven inflation rate in the Treasury market (the difference between nominal yields and real yields) has increased to the highest level since March 2023. In addition, 5–10-year inflation expectations in the University of Michigan Consumer Confidence Index rose to the highest level since 2008 (3.3%).

- Market prepares for Trump 2.0: Investors are preparing for what Trump 2.0 policies may look like. Some key economic policies revolve around tariffs, extending tax cuts, and deportations. Many economists believe these policies carry an upside risk to inflation and a rising deficit.

- Bad news for housing: The mortgage rate is priced off long term rates not the Fed funds rate. Unfortunately, the 30-year mortgage rate has climbed along with the rise in long-term Treasury yields. The 30-year mortgage is above 7.0% and it is the highest level since May 2024.

- Financials mixed: The financial sector could benefit from better net interest margins as the yield curve normalizes and they can earn more on loans. However, higher long-term rates are a headwind for small and regional banks as risks in the real estate (commercial and residential) and consumer loan market increase.

- Expensive equities at risk: Those areas of the equity market with high price to earnings multiples (technology, growth) are sensitive to a rise in yields. Therefore, we expect volatility in technology, communication services and discretionary sectors.

The Bottom Line:

It is rare that the Fed starts cutting rates and the 10 YR Treasury yield rises (10YR yield is almost 100 bps higher since the Fed cut in September 2024). This highlights how inflation is still a concern. We may have seen a near term peak in 10 and 30-year yields but investors should be accustomed to ongong volatility and invest in bonds in a defensive manner (intermediate maturing bonds).

WATCH NOW: Latest Markets With Megan Episode

Your Economic and Market Detailed Recaps

- Small business optimism highest since Oct. 2018.

- Core CPI increases at slowest pace since July 2024.

- Consumers expect inflation to be stubborn.

- Rate sensitive equities lead global rally.

- Treasury yields fall as investors assess economic data.

- Commodities post fourth straight week of gains.

Weekly Economic Recap — Inflation data slows but consumers not convinced

Small business optimism increased to the highest level since October 2018 as expectations over favorable Trump economic policies surged. Owners are expecting better business conditions as that component increased to the highest level since 2002. Sales expectations increased to the highest since January 2020.

Wholesale inflation unexpectedly eased on a monthly basis in December as the Producer Price Index increased less than expected (0.2% vs. 0.4% estimate). Food costs fell 0.1% led by a 15% decline in vegetables.

READ MORE: Understanding the Treasury Market Selloff

Headline inflation, as tracked by the Consumer Price Index, increased roughly in line with consensus estimates in December at 2.9% YoY. Energy prices, specifically gasoline prices, contributed the most to the headline increase in inflation. Shelter prices posted the smallest one-year gain since January 2022 (4.6%). Core inflation, which excludes volatile food and energy prices, increased at the slowest pace since July 2024 (3.2%) and was slightly less than consensus estimates.

The New York Fed Survey showed consumers expect higher inflation over the next three-years, increasing expectations to 3.0% in December (from 2.6% in November). Labor market expectations were broadly weaker, as confidence to find a new position in the event of a job loss fell to the lowest level since April 2021 (50.2%).

U.S. retail sales increased in December by slighly less than consensus estimates (0.4% vs. 0.6% est.). Spending at gasoline stations increased the most since April 2024. The control group, which excludes various volatile items, increased at the fastest pace in three months (0.7%).

Weekly Market Recap — Global Equities Rally as Investors Prepare for Trump Presidency; Yields Tumble

Equities: The MSCI AC World Index was higher for the first time in three weeks. U.S. equity markets led the gains and were higher for the first time in 2025 as investors prepared for President Trump’s inaguration in hopes of deregulation and lower taxes. Rate sensitive areas of the market, including small-caps and technology, led the gains as the rise in Treasury yields subsided.

Fixed Income: The Bloomberg Aggregate Index was higher last week as Treasury yields moved lower. The U.S. 10YR Treasury note finished the week ~13bps lower (at 4.63%) as investors digested inflation data and its implications on Fed policy. All areas of fixed income markets were higher led by investment grade corporate bonds.

Commodities/FX: The Bloomberg Commodity Index was higher for the fourth straight week. Crude oil prices notched their fourth straight week of gains as U.S. sanctions threaten global supply. Gold prices were higher for the third straight week as investors prepared for President Trump to take office. Bitcoin prices topped $100,000 level as investors expect Trump to release crypto-positive initiatives.

Data is as of December 2024.

Source: FactSet Research Systems, Verdence Capital Advisors