Weekly Investment Insights

Welcome Year Four of the Current Bull Market

Key Takeaways:

- Welcome to year four of the current bull market!

- History suggest bull market has room to run.

- Volatility should be expected at this stage of the bull market.

- Renewed credit fears.

- Discipline is crucial as above average returns may be borrowing from future.

Welcome to Year Four of the Current Bull Market!

Last week we officially entered the fourth year of the current bull market which began on October 12, 2022. The first week of the fourth year run was met with one of the top five longest government shutdowns since the 1970s. Renewed credit fears as two regional banks fell victim to a fraudulent loan scheme. On and off again tariff rhetoric that has kept investors wondering about economic growth. Lastly, momentum exhaustion as the PE (NTM) of the S&P 500 was trading 70% above the average seen at the start of the fourth year in the past three bull markets that made it this far (25.2x vs. 14.8x average). In this weekly insights, we will discuss historical bull market performance and compare it to the current bull market. We will also discuss the factors that are contributing to volatility (as measured by the VIX Index) jumping to the highest level in five months.

How long do bull markets last:

Going back to the 1930s, we observed 14 different bull markets and they have lasted, on average, ~four years. The longest being the bull market that started in March 2009 and lasted until the pandemic induced bear market of 2020. The current bull market has seen the S&P 500 rise ~90% which is slightly higher than the average of the past bull markets that made it into a fourth year (average ~80%). The good news is that nine of the 14 bull markets we observed continued through a fourth year. However, of those nine, this bull market saw a larger than average rise in years two and three (35% and 14%, respectively vs. average of 8% and 6%, respectively).

Government shutdown:

As of today, this shutdown is the third longest (19 days) since we started keeping records (1976). The Senate is scheduled to hold another vote today but there was not much negotiating over the weekend.

Renewed credit fears:

Regional banks are in the spotlight after a few banks (e.g., Jefferies, Zions, Western Alliance) wrote down loans tied to bankrupt auto suppliers and/or fraudulent loans in the commercial and industrial space. The S&P 500 Regional Bank Index has fallen nearly 10% this month. This has ignited fears of another regional banking crisis like Silicon Valley Bank in 2023.

Tariff uncertainty…again:

The U.S. and China are once again going head to head over trade. China’s export controls on rare earths have spurred the White House to impose additional tariffs. The White House and China have several meetings scheduled in the coming weeks to discuss the recent escalation in tariffs.

The Bottom Line:

History would suggest this bull market could continue into a fourth year with solid returns. However, investors should realize this bull market has been stronger than most in the initial years and with valuations stretched, the returns may be borrowing from future potential. Especially as we navigate through an economy that is slowing and highly dependent on the AI capex spending boom. In addition, the recent surge in volatility reminds us that valuations well above average (S&P 500 PE at 25x) may be complacent at this stage of the bull market. It is important to remain disciplined and not overpay for investments that are not rewarding investors for the risk (e.g., credit, select technology).

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Small business owners’ optimism falls to three-month low.

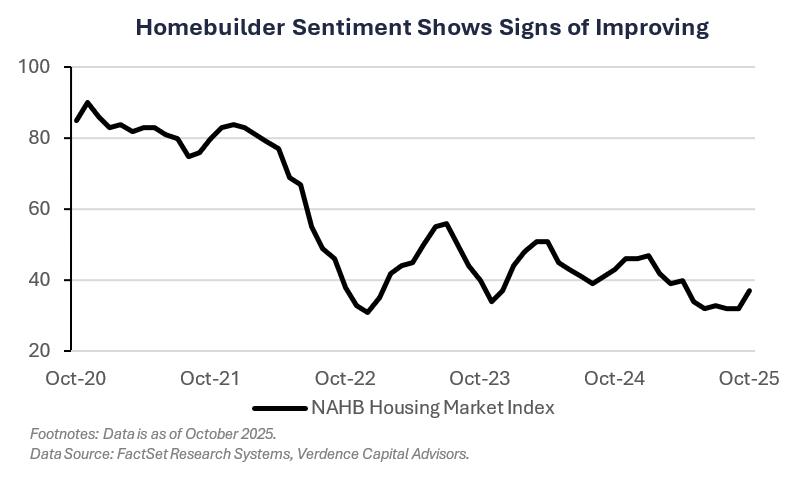

- Homebuilder sentiment improves on lower mortgage rates.

- U.S. budget deficit decreases (YoY) to $1.78 trillion.

- Global equities rally despite late-week volatility.

- U.S. 10YR yield falls to lowest level since Oct. 2024.

- Gold prices rally as investors flock to safe havens.

Weekly Economic Recap — Taking a Global Look at Data as U.S. Government Shutdown Continues

U.S. small business owners’ optimism fell to a three-month low in September according to the NFIB Small Business Optimism Index. Five of the 10 Index components decreased for the month. The net share of firms that viewed their inventories as “too low” fell by the most since 1997. The uncertainty gauge increased to the highest level since February.

China’s exports increased at the fastest pace in six months in September (8.3%, USD terms) and imports surged the most since April 2024 (7.4%, USD terms). Exports to the U.S. fell 27% in September, while imports from the U.S. fell 16% as the two countries continue to work through trade tensions.

Consumer prices in France increased 1.2% in September, but remained well below the ECB’s 2% target. Services prices increased 2.4% led by health care costs.

U.S. homebuilder sentiment, as tracked by the NAHB Housing Market Index, increased to its highest level since April (37) as lower mortgage rates started bringing buyers to the market. Sales expectations in the next six months increased to the highest level since the start of the year, while prospective buyers’ traffic increased to the highest since April.

The U.S. budget deficit fell in FY’25 to $1.78 trillion, $41 billion (2.2%) less than in FY’24. Tariff collections of $202 billion during the year helped offset a record $1.2 trillion outlays for interest on the federal debt.

Weekly Market Recap — Global Equities Rally Despite Regional Bank Weakness

Equities:

The MSCI AC World Index was higher for the second time in three weeks despite negative trade-related headlines, dovish Fed commentary, and regional bank weakness. All major U.S. averages finished the week higher with growth/technology outperforming in the large cap space. Small and midcap stocks continued to rally with the Russell 2500 Index posting its best weekly performance in eight weeks. Developed markets outperformed their emerging market peers as China equities were sharply lower as the U.S./China trade tensions escalated.

Fixed Income:

The Bloomberg Aggregate Index was higher as bond yields fell on the late-week regional banking concerns and dovish comments from Fed officials. The yield on the U.S. 10-year Treasury hit the lowest level since October 2024 on the basis of the headlines. All sectors of fixed income were higher.

Commodities/FX:

The Bloomberg Commodity Index was higher for the third time in four weeks. Gold prices were higher by the most since April, finishing the week above $4,200/oz., as investors continued to flock to the safe-haven amid uncertain U.S./China negotiations and the regional bank weakness.

WATCH NOW: Alternate View Podcast

Data is as of October 2025.

Source: FactSet Research Systems, Verdence Capital Advisors