Weekly Investment Insights

Economic Impact of Tariffs

Economic Impact of Tariffs

Tariffs, and the uncertainty, continue to be a leading driver of market moves, basically daily. We have seen headlines impact both hard data (e.g., real data points) and soft data (e.g., survey data, consumer confidence). While the Trump administration works through negotiations on a country-by-country basis, and we received good news regarding the China/U.S. relationship today, tariffs have started to impact economic data in the U.S. This week, we provide an overview of how tariffs have impacted the economy thus far and the potential investment implications moving forward.

LISTEN NOW: Markets With Megan Podcast

Soft data – Businesses cut capex spending:

Regional manufacturing surveys from New York, Philadelphia, Kansas City, and Dallas have all indicated a sharp slowdown in capital expenditure plans. Businesses are reassessing their spending plans amid rising input costs. In fact, one-year inflation expectations according to the New York Fed Survey increased to the highest level since June 2023 in April, citing increased pressures due to tariffs and supply chain disruptions. Higher input costs can shrink corporate margins and cause weaker earnings.

Soft data – Consumer confidence deteriorates:

Both consumer confidence surveys that we monitor, University of Michigan and Conference Board, have seen consumer confidence fall sharply. In fact, future expectations on the economy according to the Conference Board fell to the lowest level since 2011.

Hard data – International trade impact:

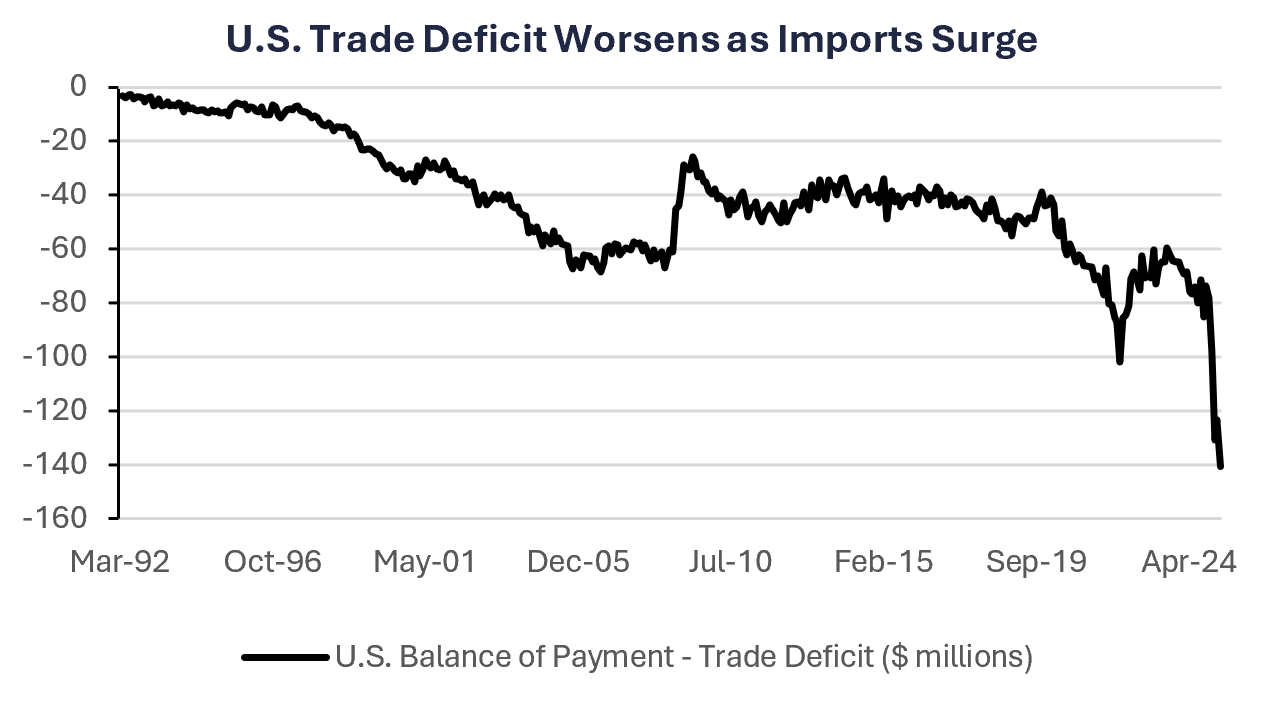

Last week, economic data showed the U.S. trade deficit widened to a record $140.5 billion in March as companies increased imports ahead of tariff plans. Imports in pharmaceuticals saw some of the most significant gains.

Hard data – Inflation pressures higher:

The ISM Services Prices Paid Index currently sits at its highest level since January 2023 (65.1), reflecting elevated input costs in the services sector. Going back to 1999, when the ISM Services Prices Paid Index crosses a reading of 60+, the average PCE reading is higher by ~0.24% and inflation was positive 70% of the time.1 As a result, we see the risk of higher PCE inflation over the next twelve months.

READ MORE: Volatility Surges As Inflation and Weak Data Rattle Investors

Hard data – GDP contraction driven by import surge:

First quarter 2025 GDP declined 0.3% as a surge in imports (which detract from economic activity) weighed on growth. Excluding the impact of net exports (exports – imports), or looking at Final Sales to Domestic Purchasers, demand remained resilient and in line with the historical average (2.2% vs. 2.3% QoQ) over the last 25 years.2

The Bottom Line:

We have just begun seeing the initial impact from the tariff uncertainty show up in survey data. We think economic data will continue to be volatile over the coming months as we navigate through weaker soft data that may filter into hard data. For example, historically, weak consumer confidence has translated into weak consumer spending. In addition, the pull forward of some spending from a consumer and/or business perspective to get ahead of tariffs may not be sustainable. Especially since the situation remains highly fluid. This economic uncertainty should keep volatility in equity and bond markets heightened.

Your Economic and Market Detailed Recaps

- Service providers see prices increase to a two-year high.

- U.S. trade deficit widens to largest in history.

- Fed stresses they are not in a rush to cut rates.

- Global equities lower for first time in five weeks.

- Yields higher on positive trade rhetoric.

- Commodities rally driven by crude oil.

Weekly Economic Recap — Fed Keeps Rates Unchanged but Sees Greater Risks

The U.S. service sector as measured by the ISM Services Index rose in April and remained in expansion territory (a reading above 50) for the 10th consecutive month. The prices-paid component increased to a two-year high of 65.1 with nearly 40% of purchasing managers reporting higher prices, the largest share since November 2022.

The U.S. trade deficit widened to a record in March ($140.5 billion) as companies rushed to import products ahead of Trump’s tariffs. Consumer goods imports climbed by the most on record, primarily driven by the largest-ever inflow of pharmaceutical products.

LISTEN NOW: Alternate View Podcast

The Federal Reserve kept interest rates unchanged at their latest meeting (at 4.25% – 4.5%). The post-meeting statement read, “the risks of higher unemployment and higher inflation have risen.” Fed Chairman Powell reiterated the committee’s stance on remaining heavily reliant on incoming data to drive decisions for interest rates and that “the economy is in a good place… we don’t need to be in a hurry to cut rates.”

Consumer borrowing increased in March by the most in three months driven by an increase in credit-card balances. Total credit climbed $10.2 billion after falling a revised $614 million in February. Non-revolving debt, including loans for vehicle purchases and school tuition, increased $8.3 billion.

The Bank of England cut interest rates by 25 bps last week to 4.25%. The central bank cited uncertainty around tariffs and underwhelming economic growth. The post-meeting press release stated, “[the] prospects for global growth have weakned as a result of [trade policy] uncertainty.”

Weekly Market Recap — Global Equities Fall Amid Trade Rhetoric and Diverging Central Bank Policy

Equities:

The MSCI AC World Index was lower for the first time in five weeks as markets were whipsawed by increased trade rhetoric and diverging central bank policy. In the U.S., the small-cap Russell 2000 was higher for the fifth straight week driven by positive trade negotiation developments. Large-caps as tracked by the S&P 500 were lower for the first time in three weeks. European equities outperformed after a trade deal between the U.S. and U.K. was announced.

Fixed Income:

The Bloomberg Aggregate Index was lower for the second straight week as yields were generally higher amid trade optimism and the Fed’s rate decision. Municipal bonds were higher for the fourth straight week on light issuance. Investment grade corporate bonds were lower for the second straight week.

Commodities/FX:

The Bloomberg Commodity Index was higher for the first time in three weeks. Crude oil prices were higher by the most since January amid positive trade developments. Gold prices dropped on hopes for additional trade negotiations.

Data is as of March 2025.

Source: FactSet Research Systems, Verdence Capital Advisors