Weekly Investment Insights

February Market Recap: Volatility Surges As Inflation and Weak Data Rattle Investors

Key Takeaways:

- Geopolitical uncertainty weighs on investor sentiment.

- Inflation proving to be a sticky problem for the Federal Reserve.

- Global equities lower as U.S. markets weigh on performance.

- Bond yields plummet (bond prices higher) as investors digest Trump rhetoric.

- Natural gas prices surge by most since October 2024 on frigid weather conditions.

February Market Recap

February was a difficult month for equity investors. Sentiment deteriorated amid geopolitical uncertainty and weak economic data. Volatility, as tracked by the VIX Index, surged as a result. Rate-sensitive equities (i.e., technology, small-caps) fell the most. Investors received some reprieve from the bond market as the Bloomberg Global Aggregate Index increased by the most since September 2024. The Bloomberg Commodity Index was also higher as extreme winter weather sent the price of natural gas higher. This week, we analyze the month of February from an economic and asset class perspective.

- Inflation proving to be a problem: The headline Consumer Price Index increased at a 3.0% YoY pace, led by shelter and food costs. The Fed’s preferred inflation gauge, PCE Core, increased 2.6% YoY. Both readings are above the Fed’s 2% target.

- Consumer sentiment deteriorating: Consumer sentiment as tracked by the University of Michigan plunged to a 15-month low as consumers grow concerned over future economic conditions. Inflation expectations climbed to their highest level since April 1995.

- Consumers pull back on spending: Retail sales posted the largest monthly drop in two years last month as consumers slowed their pace of spending amid persistent price pressures.

- Struggling housing market: Higher borrowing costs and fears of increased material prices for construction led to fewer home construction projects and historically low home sales.

Global Equities – U.S. lags global peers: The MSCI AC World Index was lower in February amid increased geopolitical tensions. U.S. markets were a drag on global performance.

- (Not so) “Magnificent 7”: Last year’s mega-cap tech darlings drove the S&P 500 lower in February. Only Apple and Nvidia posted marginal gains. Tesla performed the worst, falling ~28%.

- Value sectors outperform in the U.S.: The Russell 3000 Value index outperformed its growth counterpart for the second straight month on a relative basis and by the most since July 2024.

- China equities lead global rally: Equities in China led global market performance in February as investors cheered better-than-expected tech earnings in the region.

Fixed Income – All sectors higher: The Bloomberg Aggregate Index was higher for the second consecutive month and by the most since September 2024.

- Yields broadly lower: Treasury yields were lower in February (bond prices were higher) as investors digested disappointing economic data and Trump’s tariff threats.

- Yield curves narrow on economic outlook: A closely watched yield curve by the Federal Reserve (10YR yield – 3MO yield) inverted in late February. Other key Treasury curves narrowed as investors digested weak economic data.

Commodities: The Bloomberg Commodity Index was higher for the fourth straight month. Natural gas prices surged amid frigid weather conditions.

READ MORE: Addressing Causes of Recent Market Volatility

Your Economic and Market Detailed Recaps

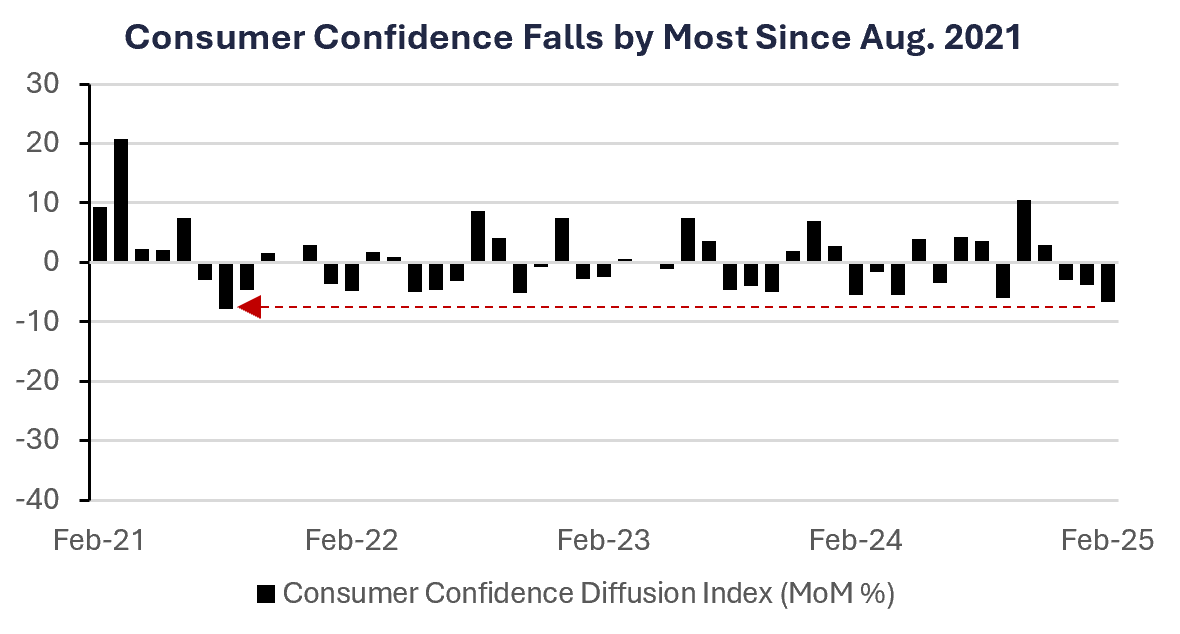

- Consumer confidence deteriorating.

- No reprieve for the housing market.

- PCE Core increases at slowest pace since March 2021.

- Global equities lower on increased tariff concerns.

- All fixed income sectors rally; Treasury yields plummet.

- Commodities lower by most since February 2023.

Weekly Economic Recap — Confidence Deteriorating as Inflation Pressures Remain Stubborn

Consumer confidence fell for the third straight month and by the most since August 2021. Inflation expectations over the next year increased to the highest since May 2023 and the share of respondents expecting a recession in the next year rose to a nine-month high.

Sales of new homes in the U.S. fell in January to a three-month low amid affordability challenges and frigid winter temperatures deterring traffic. Sales plummeted 15% in the South, the largest homebuilding region, as several areas experienced record snowfall in January. The median selling price of new homes increased to $446,300, a record high for the month of January.

Pending home sales, which are based on signed contracts for existing homes, fell in December to the lowest level since the National Association of Realtors began tracking the metric in 2001. Extreme winter weather was a factor, but higher 30YR mortgage rates and elevated home prices were the largest contributors.

Initial filings for unemployment benefits increased to their highest level of the year last week (242k), matching the highest level since early October 2024. New claims for benefits surged 26% in Washington D.C. amid Trump’s plans to reduce the federal workforce.

The Fed’s preferred inflation gauge, PCE Core, increased at a 2.6% YoY pace in January, matching the smallest annual increase since March 2021. The headline increase was attributed to higher energy prices, specifically crude oil, which showed a 2% YoY increase.

Personal income increased 0.9% in January. Consumer spending, however, fell at the fastest pace in four years, driven by slower spending on services.

Weekly Market Recap — Global Equities Lower as Investors Digest Increased Geopolitical Tensions

Equities: The MSCI AC World Index was lower for the second straight week amid increased tariff rhetoric from President Trump. In the U.S., the Dow Jones Industrial Average was the only index higher. Value sectors outperformed growth sectos and the “Magnificent 7” components were lower on fears the AI rally could be losing steam. European equities, specifically shares in the U.K., outperformed global peers amid stronger-than-expected earnings results.

Fixed Income: The Bloomberg Aggregate Index was higher for the seventh straight week as investors digested weaker-than-expected economic data. Treasury yields were sharply lower (bond prices were higher) on the data releases, as well as a contentious meeting between the White House and Ukrainian officials. All sectors of fixed income markets were higher, led by investment grade corporate bonds.

Commodities/FX: The Bloomberg Commodity Index was lower for the first time in four weeks and by the most since February 2023. Natural gas prices were lower for the first time in three weeks as warmer-than-normal temperatures decreased demand. Gold prices were lower on a stronger US Dollar on expectations of a more cautious Federal Reserve.

LISTEN IN: Alternate View Podcast

Data is as of February 2025.

Source: FactSet Research Systems, Verdence Capital Advisors