Weekly Investment Insights

Recession Indicator Shows Cracks Getting Bigger

Key Takeaways:

- Economic data and recession indicators pointing toward a slowdown.

- It is important to remember recessions are a normal part of the business cycle.

- Manufacturing activity in expansion territory, but cracks emerging again.

- Consumer confidence deteriorating.

- Labor market resiliency showing signs of slowing.

Recession Indicator Shows Crack Getting Bigger

Economic data has been showing signs of deteriorating and recession fears have accelerated as a result. In this weekly insights, we revisited our recession indicator model that compares 15 different economic indicators and how they weakened leading up to prior recessions. We then compared them to the current period to see if a slowdown is ahead. We found that most of the data points are already at or below the levels seen in the months leading up to prior recessions. 1

Manufacturing activity as tracked by the ISM Manufacturing index was in contraction territory (a reading below 50) from November 2022 – December 2024. The previous two months of readings indicated modest expansion, but ISM officials believe the expansion has been attributed to customers getting ahead of tariffs.2

Another area of concern for us is consumer confidence as it can be a leading indicator for spending. Both consumers’ confidence on present conditions and their expectations for future conditions are deteriorating. Additionally, the most recent confidence reading (February 2025) indicated consumers are more pessimistic about the labor market as future employment prospects are sitting at a 10-month low.

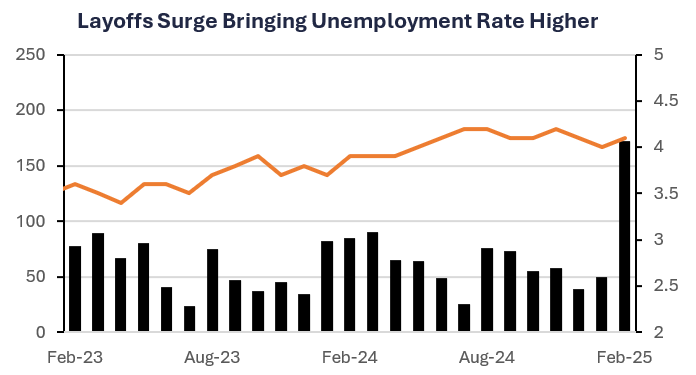

While the labor market indicators are still strong compared to the month leading into past recessions, signs are accelerating of a weaker labor market ahead.

We remain concerned about economic growth in 1H25. The consumer is the biggest threat as debt and higher prices are straining balance sheets. We expect this valuation correction in equities to continue as investors were complacent coming into 2025 about the economic and inflation risk.

READ MORE: February Market Recap

Your Economic and Market Detailed Recaps

- ISM Manufacturing and Services readings show higher prices.

- S. employers cut jobs at fastest pace since July 2020.

- S. economy adds fewer jobs than expected.

- S. equities continue to be a drag on global performance.

- Longer duration bonds fall on inflation fears.

- Natural gas prices higher on increased demand.

Weekly Economic Recap — Labor Market Starting to Crack

The ISM Manufacturing Index remained in expansion territory for the second consecutive month in February (a level above 50). Prices paid led the increase in the Index by jumping to the highest level since June 2022. Supplier deliveries increased to the highest level since August 2022. However, there was a steep drop in new orders, which fell at the fastest month over month pace since April 2020.

Activity in the services industry increased at a faster than expected pace in February, according to the ISM Services Index. The employment gauge increased to the highest level since December 2021. A measure of prices paid increased to one of its highest levels since early 2023.

U.S. employers cut jobs at the fastest pace since July 2020 (172k) and at a 103% year-over-year pace according to the Challenger Job Cuts announcements. The federal government was responsible for the largest share of job cuts at ~62k. The retail and technology sectors were the next largest contributors.

The U.S. trade deficit increased in January by ~$131 billion as companies stocked up on goods from overseas ahead of Trump’s tariffs. Imports of consumer goods increased, driven by pharmaceuticals and cell phones, specifically. Canada’s trade surplus with the U.S. increased to a record in January amid a surge in exports of cars, auto parts, and oil.

The U.S. economy added slightly fewer jobs than expected in February (151k vs. 160k est.). Health care led the job creation, while federal government employment declined by 10,000. However, the unemployment rate ticked higher (to 4.1%) and Americans holding part-time jobs for economic reasons increased to the highest since October 2021 (8%).

Weekly Market Recap — U.S. Equities Falter as Growth Concerns Arise

Equities: The MSCI AC World Index was lower for the third straight week. U.S. markets continued to underperform their global peers amid increased uncertainty about tariff policy raising economic growth concerns. The S&P 500 posted its worst weekly decline since September 2024. Eurozone equities were broadly higher driven by outperformance from Germany on the prospect of increased defense spending. China equities were higher after the country announced economic growth targets in line with consensus.

Fixed Income: The Bloomberg Aggregate Index was lower for the first time in eight weeks. Longer duration bonds led the weakness as investors remain concerned on the long term inflation implications from tariffis. Credit across investment grade, high yield and EM bonds also fell.

Commodities/FX: The Bloomberg Commodity Index was higher for the fourth time in five weeks. Natural gas prices were higher amid increased demand on colder weather. Crude oil fell on economic growth fears. Gold prices were higher on increased demand for safe-haven assets.

LISTEN IN: Alternate View Podcast

Data is as of February 2025.

Source: FactSet Research Systems, Verdence Capital Advisors